Popular & Trending

Discover the risks of unlicensed moneylending in Singapore and how to protect yourself. Learn legal options, safe borrowing, and financial literacy tips.

Learn why financial literacy is essential for every Singaporean. Discover how understanding mortgage loans and home loan interest rates can protect your financial future.

Discover why Singapore’s “super heartlands” — Bishan, Toa Payoh, Tampines, and Ang Mo Kio — outperform in property value growth and how this can help you choose the right mortgage in Singapore or refinance your home loan for long-term gains.

Article Categories

News Articles

Find out which 3 Key Pillars in the Singapore Green Plan 2030 will make a difference to homeowners

After almost a whole year of waiting, Singapore's property cooling measures have finally been announced. Here's what property buyers need to know in 2021

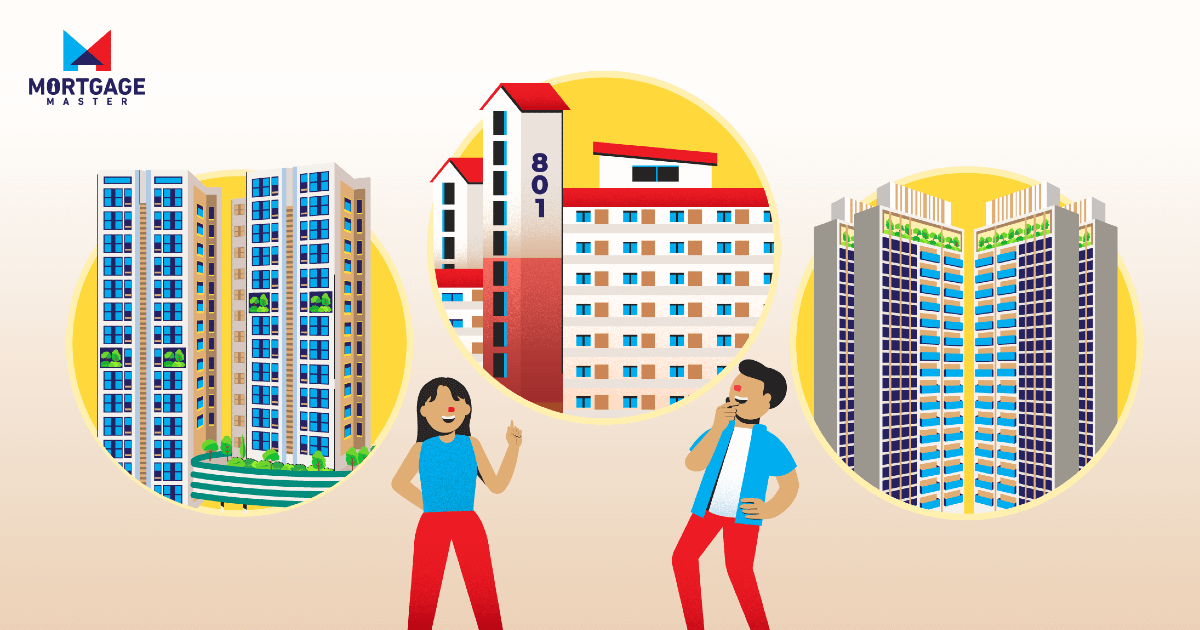

With the introduction of the HDB PLH model, homebuyers in Singapore now have one more property type to consider! We look at 6 factors and see how the HDB PLH model compares.

Is the HDB PLH model a good thing for Singaporeans wanting to live in prime locations? We weigh the pros and cons of this new innovation

Understanding the HDB Prime Location Public Housing (PLH) model in Singapore: Learn about the eligibility criteria, restrictions and benefits of PLH flats.

With news that HDB resale price records have been broken yet again, this time with a $1.36m 5-room flat in Bishan, we take a look at what the next million dollar HDB flat might be

With rising property prices and property investment getting trickier, should you rethink the Singaporean Dream?

With 174 transactions so far, 2021 has set a new record for the highest number of million dollar HDB flats being sold in a year. Here's how you can check if you're living in one.

It's been almost 7 years, but cash over valuation is back in the picture! Here's what it means if you're buying or selling a resale HDB flat or a private property

Mortgage brokering platform helps homeowners in Singapore save more than SG$100 million in home loan repayments throughout the pandemic.