When buying property in Singapore, location is just as important as securing the right mortgage in Singapore. Some neighbourhoods not only hold their value well but also keep appreciating steadily. This makes them a smart move for both property investment in Singapore and long-term mortgage planning.

Here at Mortgage Master, we call these “super heartlands”, and understanding them can help you make better property choices and choose a mortgage that truly works for you.

What Exactly is a “Super Heartland” in Singapore Property Investment?

We all know what “heartland” means: HDB towns where most Singaporeans live. But not all heartlands are equal. Some have proven to outperform the rest in terms of property price growth in Singapore.

These are some examples of the super heartlands: Bishan, Toa Payoh, Tampines, Clementi and Ang Mo Kio.

Here’s what makes them different from the usual heartlands like Woodlands or Jurong:

- Higher-income households – Residents often have stronger spending power, which sustains property demand.

- Proximity to landed property – Landed homes nearby naturally boost surrounding property values.

- Long-term price resilience – Even after 10–20 years, property prices in these estates tend to keep rising.

The Data Behind Super Heartlands’ Price Growth in Singapore

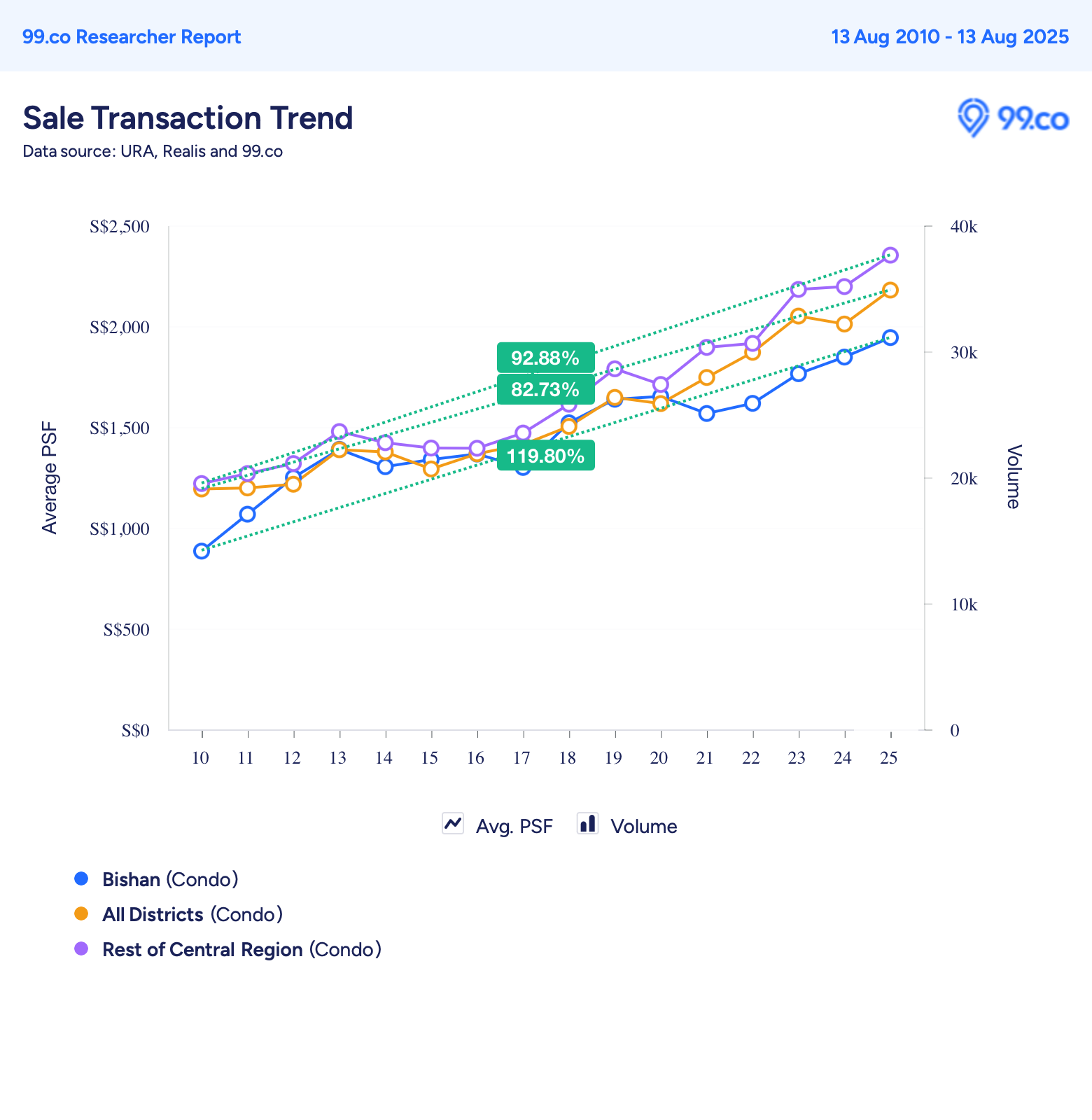

Take Bishan as an example:

- Average resale condo price: about $1,944 psf, slightly below the central region’s $2,179 psf (Source: 99.co).

- 15-year price growth: Bishan condos have risen by 119.80%, compared to 82.73% for the overall condo price growth in Singapore.

- Bishan Condo vs RCR Condos Growth: Bishan condo prices grew 119.80% across the last 15 years, while RCR condo prices climbed 92.88%.

This steady growth is backed by strong fundamentals — prime location, better-than-average incomes, quality schools, and excellent transport links.

Clement Canopy: A Case Study for Mortgage and Property Buyers in Singapore

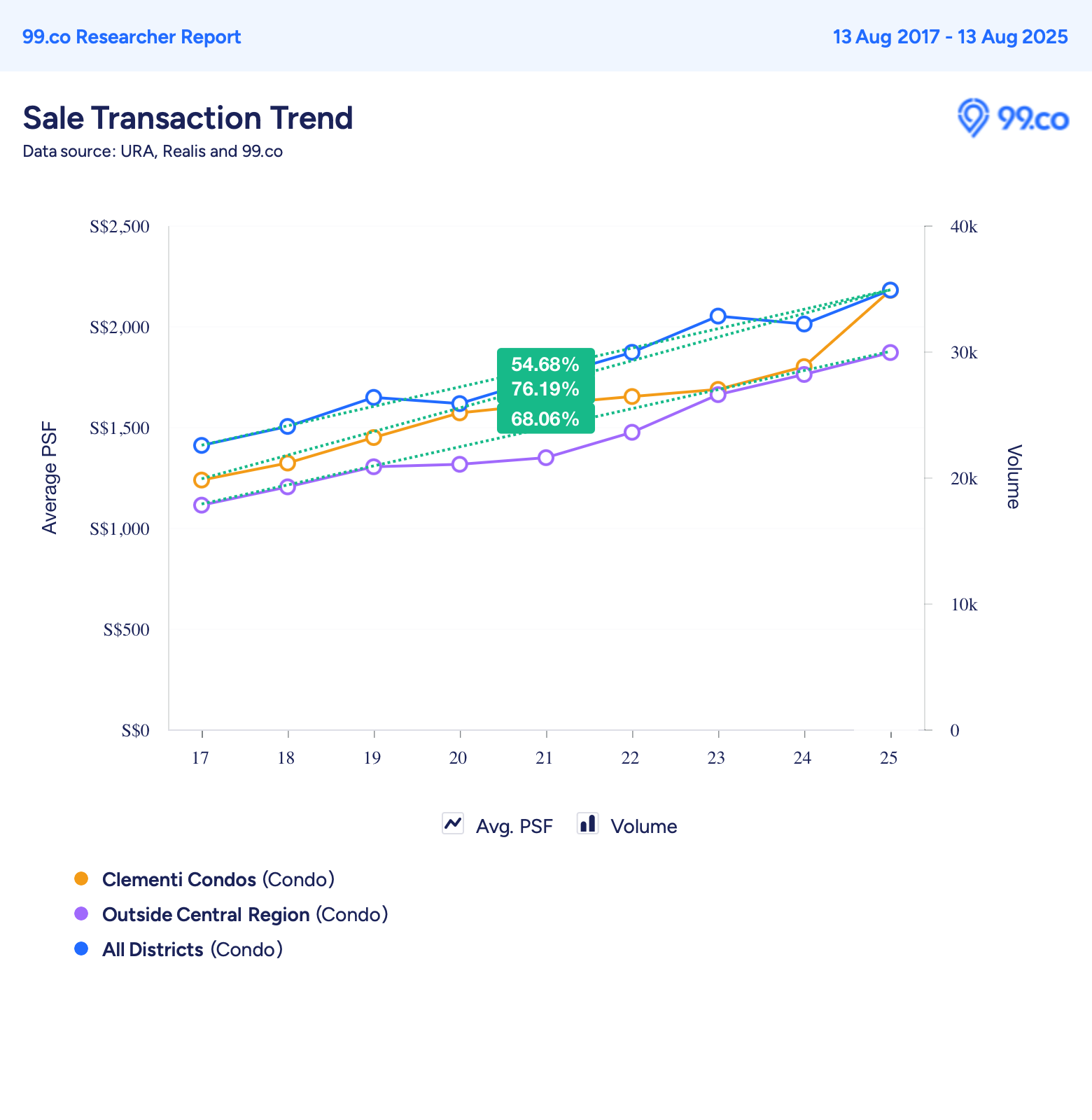

While Clementi may not be one of the “classic” super heartlands, it shares many of the same winning traits — mature amenities, reputable schools, excellent connectivity, and proximity to landed housing.

Looking at the numbers:

- Average resale condo price: ~$2,178 psf — 16.5% higher than the regional average of $1,869 psf (Source: 99.co).

- 8-year price growth: Clementi condos have risen 76.19%, outperforming Singapore’s overall condo price growth of 54.68%.

- OCR comparison: Clementi’s growth of 76.19% also beats the Outside Central Region (OCR) average of 68.06%.

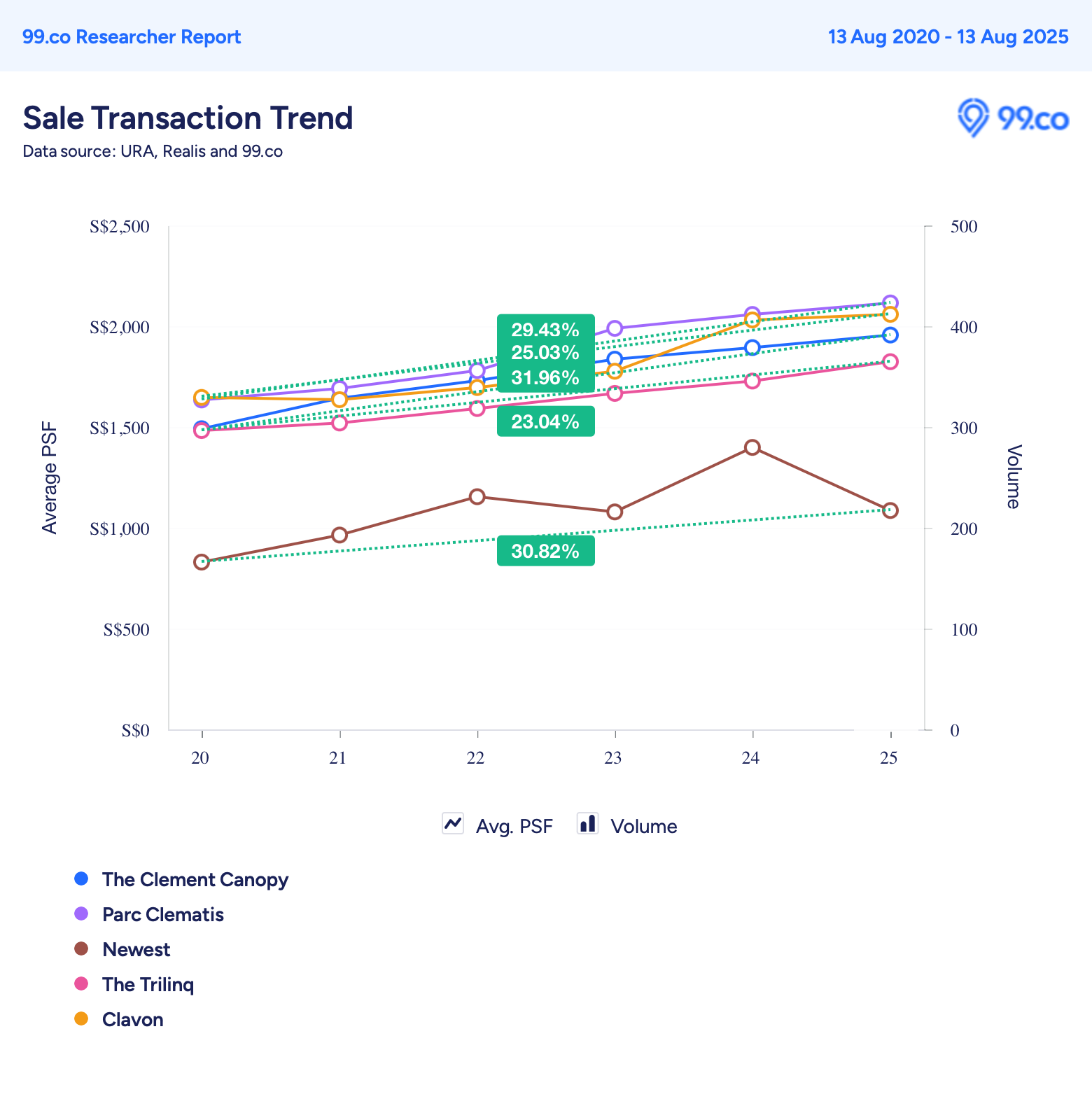

If we compare the five newest launches in Clementi — The Clement Canopy, Parc Clematis, Newest, The Trilinq, and Clavon — The Trilinq recorded the weakest growth, while The Clement Canopy emerged as the top performer.

The Clement Canopy in particular demonstrates how the right location drives value:

- Launch (2017): Averaged $1,371 psf (Source: 99.co).

- Recent (2025): Averaging around $1,956 psf (Source: 99.co).

- Strong demand factors: Award-winning green design, thoughtful layouts, and a sought-after location.

Some buyers initially dismissed the project due to its perceived distance from the MRT. But in reality, the nearby bus stop at Block 410 offers a direct connection to the MRT, making it more accessible than many expect.

For both buyers and investors, this is the kind of property that offers robust capital appreciation potential and supports stable, long-term home loan planning.

Why This Matters for Your Mortgage and Refinancing Strategy in Singapore

Buying in a super heartland isn’t just a location choice — it’s part of a long-term mortgage strategy.

From a financing point of view:

- Lower risk – Strong location fundamentals protect property values, reducing loan-to-value risk.

- Better refinancing potential – Consistent or rising valuations make it easier to refinance your home loan in Singapore.

- Improved wealth growth – Appreciation means your asset works harder for you, boosting your overall property portfolio returns.

As mortgage consultants in Singapore, we’ve seen first-hand how choosing the right area can make refinancing smoother, lower interest costs, and improve financial flexibility over the years.

Final Thoughts

When it comes to buying your next home or refinancing your mortgage in Singapore, don’t just focus on locking in the lowest interest rate because location matters just as much. A well-chosen property in a growth-ready area, like Singapore’s super heartlands, can appreciate steadily over time while keeping your home loan manageable.

Super heartlands have a proven track record of delivering stable returns for decades. If you’re ready to make your next move, pair a smart property choice with the right mortgage strategy.

Speak to Mortgage Master today for personalised mortgage advice and the best home loan deals in Singapore — so your property and your finances can grow hand-in-hand.