For Singaporeans, property is much more than just an asset class. It is a key part of the government’s strategy to create a cohesive community with well-thought-out social integration policies. At the same time, it is also a way of giving all Singaporeans ‘skin in the game’ to ensure and enjoy Singapore’s economic success. It is what defines the Singaporean Dream.

But over the years, the property market has experienced many changes. Is the Singaporean Dream still valid for the younger generation? Should you be rethinking about the Singaporean Dream?

Let’s break down the 5 ways in which the property market has changed since your parents’ era and whether you should be rethinking the Singaporean dream?

1. Can Property Prices Still Appreciate?

Since our parents’ era, property prices have been on a growth spurt. The Singapore residential Property Price Index (PPI) is climbing from 8.9 in 1975 to 163.5 today.

source: tradingeconomics.com

The current PPI reading of 163.5 is the highest PPI ever been recorded in the history of Singapore’s residential property market. This begets an important question that many existing and future homeowners are concerned with: Can property prices still appreciate?

Though we don’t have a crystal ball that can peer into the future, we think the answer is likely to be yes. And here’s why.

For an island-state like Singapore, supply is always limited. No matter how well Singapore does its urban planning, how tall our buildings go or how much land we reclaim, there is a limit to how many properties we can build to provide for Singapore’s residents.

If Singapore can continue to attract foreign companies and talents to continue investing in Singapore, Singapore’s economy will continue to stay strong. This will create a strong demand for housing in Singapore.

Since demand and supply dynamics is the foundation behind the rise and fall of property prices, limited supply and healthy demand for housing driven by the economic stability of Singapore will continue to prop up housing prices. But do note that you can no longer go into the property market blindly and expect to make 5x returns like your parents did.

Instead, you will need to be more savvy and make a calculated choice when buying your first home.

2. Can Future Generations Afford Their Own Home?

The continued growth and appreciation of property prices in Singapore is music to the ears of existing homeowners. But what about the future generation who have yet to own our first home? Can you afford your own home amidst the appreciation of property prices in Singapore?

In the past, your parents didn’t have to worry about being priced out of a place they can call home. There was plenty of public housing and plenty of support from the government to buy their own home.

Source: HDB

Source: HDB

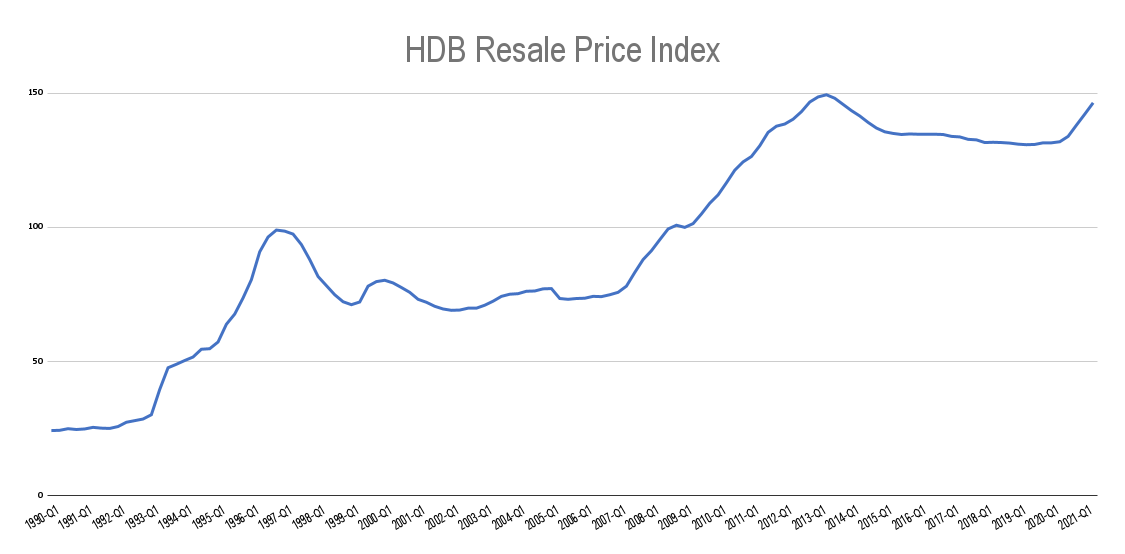

Today, HDB prices is almost near its all-time high. The latest HDB Resale Price Index (RSI) reading is at 146.4 (vs all-time high of 149.4 in 2013) and seems to be on an upward trend for the next leg of growth.

That said, building a home for everyone is still very much Singapore’s belief. From grants for lower income families to an evolving public housing scheme, the government is doing its best to ensure that Singapore’s home ownership continues to stay high.

For instance, the government is providing more grants for first-time homebuyers who are looking at resale flats to make it more affordable. The government is also always keeping an eye on the property market to ensure it doesn’t overheat so that Singapore avoids Hong Kong’s situation.

While the government can’t guarantee that city or city fringe homes won’t continue to rise, the government is doing its best to ensure future homeowners can still afford homes with the provision of right amount of grants.

3. HDB Prices No Longer Pegged To Market Price

For decades, BTO prices of HDB flats were indirectly determined by the resale market. So, if someone is selling their flat at record high prices, BTO prices in the same estate will shoot up.

However, this model of pegging BTO prices to the HDB resale market was redesigned into a cost-plus model by Mr Fix-it, then Minister for National Development Khaw Boon Wan.

Under the cost-plus model, the price of BTOs will be based on the construction cost of the project plus a markup. If the construction prices go up, then price of BTOs will go up. But it will not have any impact by the rising prices in the resale market.

The shift into a cost-plus model helped to ensure that BTOs continued to stay affordable even as the general property market was on the rise. Furthermore, the government is also taking a closer look whether this pricing model works for future BTOs, especially in newer developments like Greater Southern Waterfront, to avoid the “lottery effect”.

In short, even as property prices in the resale market continues to climb, you will still be able to afford BTOs, at the very least. The only thing to lament is that wait time for BTOs is still quite long, even though much has been done to cut it done by 1-2 years since your parents’ era.

4. Homes Are Getting Small, Smaller, Smallest

The size of homes has been shrinking since your parents’ era. Since the 1980s, HDB home sizes have shrunk from ~25 sqm per room to ~22.5 sqm per room. This represents a fall between 10% to 15%, depending on the flat type.

This shrink is even more poignant for condos. According to The Straits Times, the median size of new launch condo units shrunk from 116 sqm to 71 sqm between 2007 and 2020. This represents an almost 40% fall in size.

Proponents of smaller units argue that it is due to the trend of smaller families. Since the average family size is also smaller, families don’t need such a huge space like they did in the past. This trend is also visible in other parts of Asia, not just in Singapore.

With shrinking home sizes, the price premium for bigger homes will only get more distinct over time. For our parents, the luxury of space is something that they were gifted. But for future homeowners, it is a choice that you will need to make and consider whether it is worth paying the price premium.

5. What Is The Value Of Property When The 99-Year Leasehold Is Up?

To quote Singapore’s founding prime minister Mr Lee Kuan Yew, the value of housing will “never go down”. This was a statement he made at the launch of Tanjong Pagar GRC's 5-year Master Plan to which he was referring to the home renewal and refurbishing programme that was intended to help maintain the value of HDB homes.

But what about the fact that majority of properties in Singapore have a 99-year leasehold? What happens when the lease is up? Is the value of one’s property going to reset to zero as the property is reclaimed by the government?

For private properties, the lease issue seems to be taken care of by the enbloc market since developers can choose to enbloc older properties, redevelop and then sell them as a new launch condo. This is partly still feasible because of the high redevelopment potential of existing condos as the land was under-utilised.

For HDBs, Voluntary Early Redevelopment Scheme (VERS) was unveiled in the National Day Rally 2018 to tackle the issue of diminishing lease for the older HDB flats. That said, details of VERS is still very much in discussion in the Ministry of National Development to decide what’s a fair amount to pay HDB homeowners.

Moving forward, the fact that there is a chance the property value might go to zero is something that the next generation of homeowners need to face head-on. You will need to keep this in the back of your mind when making your next property decision and not expect to be “bailed out” when the lease on your property expires.

Should You Rethink The Singaporean Dream?

Even though the property has changed so much since your parents’ era, it is hard to ignore the fact that property is still an important asset class for Singaporeans. For that, it still deserves to continue as a mainstay in any Singaporean's portfolio.

That said, there are bound to be some changes in the way you have to be smart about your property. For instance, you need to be more discerning when it comes to buying a property. You can no longer hope to make 5x returns without doing your due diligence.

You will also need to be more savvy when it comes to refinancing your property so that you can take advantage of the low interest rate environment. The low interest rate is definitely something that defines your generation and something which your parents didn’t have in their era.

At Mortgage Master, we know the latest home loan packages in the market and sometimes can even offer exclusive interest rate packages that you cannot get directly from the bank. If you're looking to purchase a new property, or refinance your existing home loan, fill up our enquiry form and our mortgage consultants will follow up with a call.