Popular & Trending

Discover the risks of unlicensed moneylending in Singapore and how to protect yourself. Learn legal options, safe borrowing, and financial literacy tips.

Learn why financial literacy is essential for every Singaporean. Discover how understanding mortgage loans and home loan interest rates can protect your financial future.

Discover why Singapore’s “super heartlands” — Bishan, Toa Payoh, Tampines, and Ang Mo Kio — outperform in property value growth and how this can help you choose the right mortgage in Singapore or refinance your home loan for long-term gains.

Article Categories

News Articles

Funding round was oversubscribed and closed within eight days. Strategic capital will reinforce Mortgage Master's vision of ensuring homeowners in Southeast Asia can conveniently find the best mortgages tailored to their needs.

Last week in Parliament, there were several announcements making purchasing an HDB flat easier. However, there have yet to be any details about government policies that would affect future HDB homebuyers. We discuss their effect on HDB flat prices.

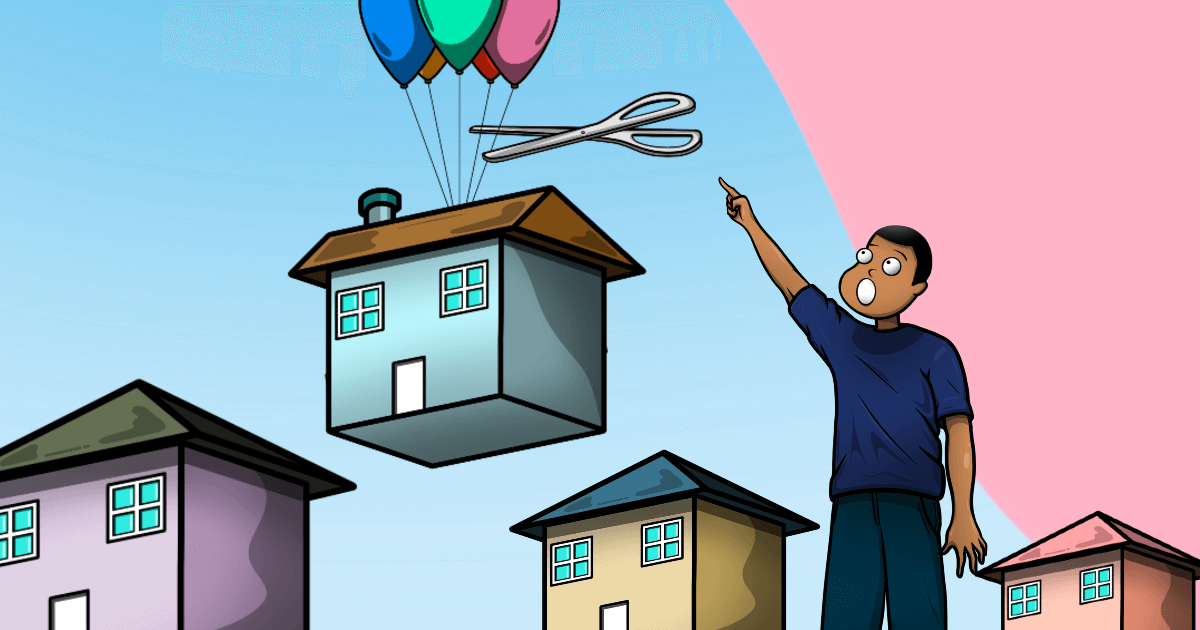

Will there be new property cooling measures announced at Budget 2021 this afternoon? All signs point to yes. But what can we expect? Here's a look back at how ABSD, SSD, TDSR and MSR affected property prices in Singapore

With many airlines being affected by the COVID-19 pandemic, Mortgage Master has started a referral programme to help affected cabin crew earn additional income during these troubled times.

It was an interesting day in Parliament when Dr Jamus Lim of the Workers' Party gave his maiden speech. Of interest to us, the concept of "remortgaging" came up! We discuss what Dr Jamus and Mr Sitoh Yih Pin were actually talking about.

Despite the effects of the COVID-19 pandemic, on top of entering Singapore's worst recession since independence, property prices aren't falling... yet. Our CEO, David Baey shares his insights about what this means for the property market in the near future.

What will the newly elected 14th Parliament be addressing regarding mortgage and housing loan rates? We took a look back at 3 times earlier this year when the 13th Parliament discussed these issues.

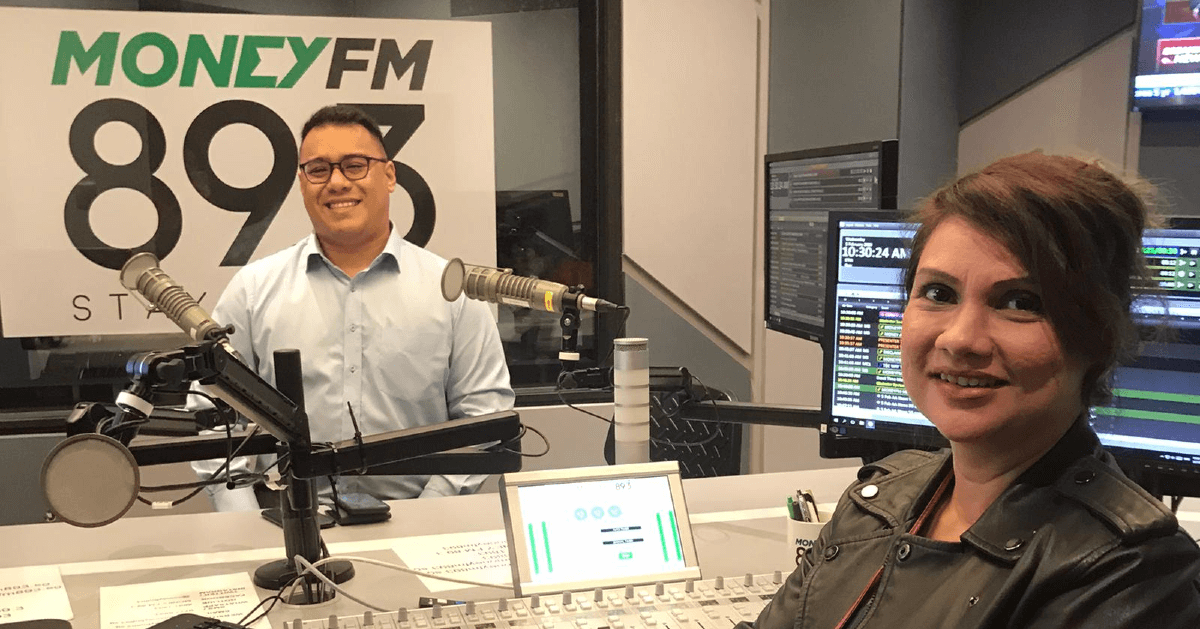

On 5 February 2020, Mortgage Master CEO David Baey was interviewed by Michelle Martin on Money FM 89.3 about choosing the best mortgage loan. Here is the interview transcript.

When one bank in Singapore announced they were raising their interest rate floor, the backlash was swift. But what is an interest rate floor and are banks allowed to raise it? I mean... it's supposed to be a FLOOR, right?

On 31 March 2020, MAS announced a slew of financial relief measures for individuals, especially those affected by the COVID-19 pandemic and the economic downturn. So should you apply for mortgage deferment?