Singapore’s public housing model has long been recognised as a global benchmark. Its meticulous design and effectiveness have served Singaporeans well for decades.

Therefore, the 2021 announcement of the new Prime Location Housing (PLH) model by HDB marked a significant development, warranting close attention from all those invested in Singapore's housing landscape.

In just 8 minutes, we'll equip you with the key information you need to know regarding the HDB PLH model.

What is the HDB PLH Model?

Introduced on 27th October 2021, the HDB PLH model is a new framework designed to address the "lottery effect" in the housing market. This term refers to the unexpected financial gains some HDB flat owners in prime locations experience when they sell their properties.

The substantial appreciation in value is due to the desirability of these locations, often acquired through the Built-to-Order (BTO) ballot system. The element of chance in securing these sought-after units has led to this commonly used phrase, with a prime example being the Pinnacle@Duxton, where numerous flats have been sold for over a million dollars.

Who Is Eligible To Purchase Under The HDB PLH Model?

Under the HDB PLH model, homebuyers for BTOs — in what HDB has referred to as prime, central locations — will be subjected to the same eligibility requirements for regular HDB BTOs. However, there are new restrictions for the purchase of PLH resale flats. Unlike typical resale units, PLH resale flats can only be sold to buyers who are eligible for HDB BTOs.

This means that in order to purchase a HDB flat under the PLH model, you need to be married or have the intention to get married, i.e. under the Fiancé/Fiancée Scheme. Apart from your marital status, you and your partner will also need to be under the prevailing income ceiling, which currently is $14,000.

Note that this applies not only when you apply for the BTO, but also for resale flats under the PLH model. In addition to these requirements, neither you nor your partner can have owned a private property in the last 30 months, and one of you needs to be a Singaporean.

Can Singles Buy PLH?

Unfortunately, as there are currently no 2-room Flexi flats in the PLH model, this means that singles will not be eligible to apply for PLH flats in the BTO exercise, nor buy them on the resale market.

Which Areas Do the HDB PLH Model Affect?

While the HDB PLH model’s definition of "prime, central locations" remains ambiguous, we can infer its meaning from various sources:

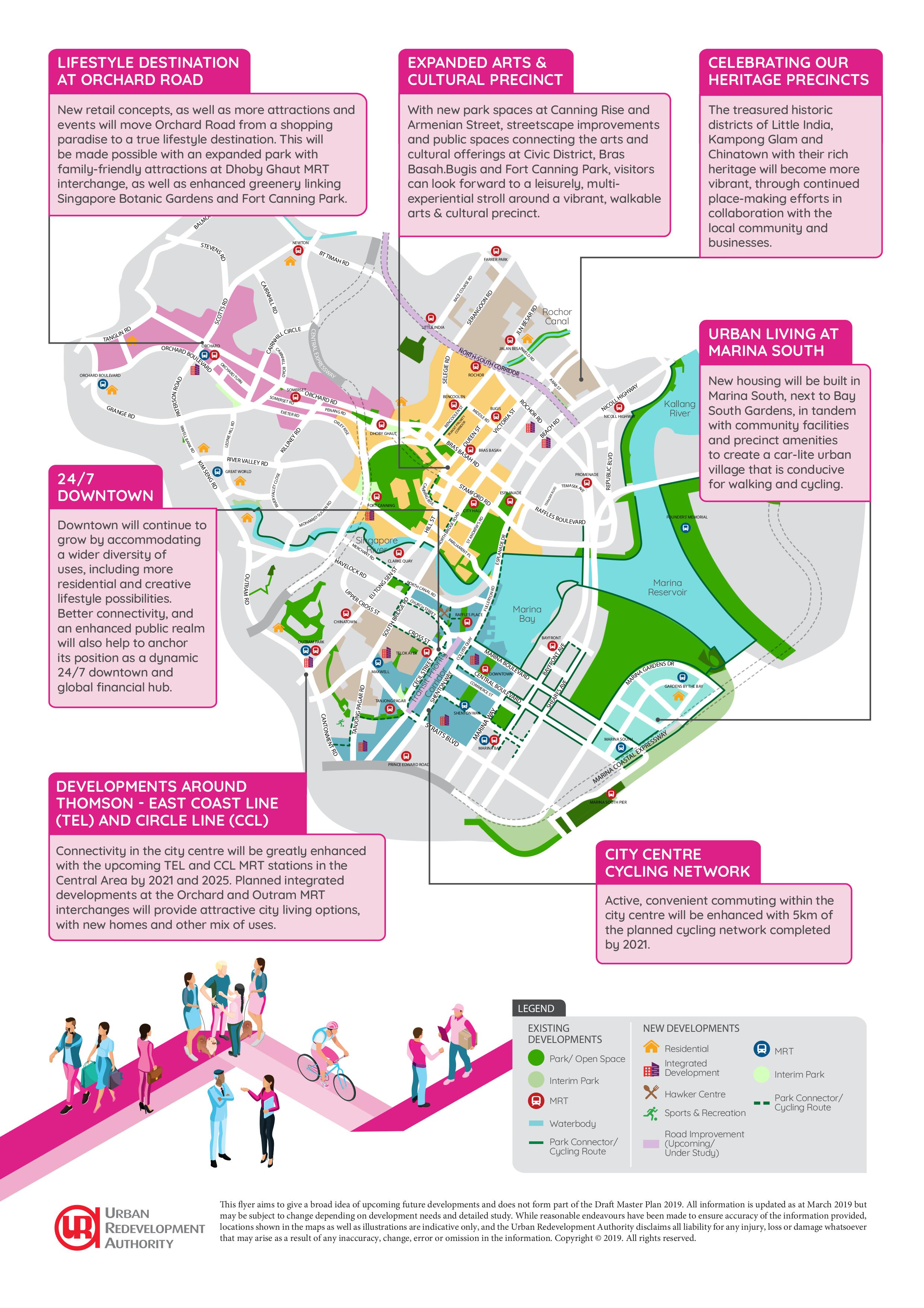

Source: URA

For example, the URA Master Plan has a clearly defined region for the Central Area (not to be confused with the surrounding Central Region). Under the URA Master Plan 2019, the Central area includes Rochor, Bugis, the Central Business District (CBD), Marina Bay and Orchard. The first BTO under the HDB PLH model was also noted to be in Rochor, which confirms this hypothesis.

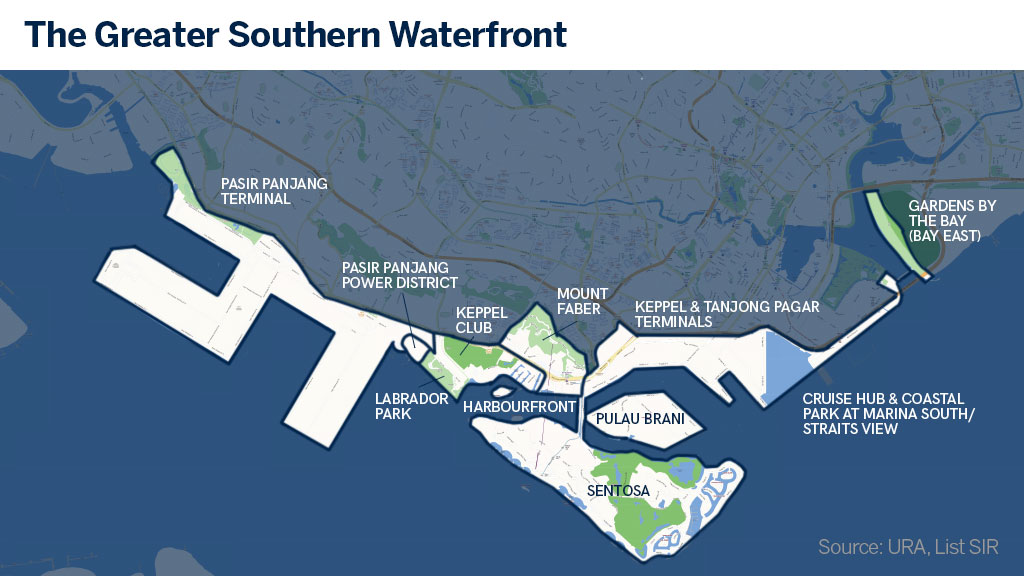

Source: List International Realty

In addition to the CBD and Orchard areas, the Greater Southern Waterfront (GSW) is likely to be classified as a Central Area under the PLH model as well. Following its mention in the 2019 National Day Rally, discussions also arose regarding the affordability of public housing in such prime locations.

Given the potential for high property prices in the GSW, increased subsidies may therefore be necessary to maintain affordability. However, it's important to note that these higher subsidies would only be applicable if the GSW is indeed officially designated as a Central Area.

To give you a better idea of the currently available projects, please refer to the table below:

| Project Name | Location | Flat Types Offered | Estimated Completion Date | Key Features |

|---|---|---|---|---|

| Garden Waterfront I & II | Kallang/Whampoa | 3-room, 4-room | Q3 2028 | Close to Kallang MRT station, waterfront living, green spaces |

| Ulu Pandan Banks | Queenstown | 3-room, 4-room | Q4 2028 | Near Dover MRT station, parks and green spaces, community facilities |

| Ghim Moh Ascent | Queenstown | 3-room, 4-room | Q4 2028 | Close to Buona Vista MRT station, nature trails, educational institutions |

| Farrer Park Fields | Kallang/Whampoa | 3-room, 4-room | Q3 2028 | Near Farrer Park MRT station, city fringe location, amenities |

| [Upcoming Project] | Queenstown | TBD | TBD | Details to be announced in May 2025 BTO launch |

What Are The Benefits Of The HDB PLH Model

The HDB PLH model offers several key benefits that make it an attractive option for those seeking public housing in prime locations, including:

- Affordability: PLH flats are subsidised to keep them accessible to a wider range of buyers. This makes the dream of owning a home in a prime location a reality for more Singaporeans.

- City Living: The PLH model offers a chance to live in central locations without the hefty price tag typically associated with private property.

- Price Appreciation: While public housing is primarily for owner-occupation, the potential for price appreciation in prime locations is undeniable. PLH flats, despite the restrictions, are likely to see value increases due to their desirable locations.

- Social Mixing: The PLH scheme promotes a more diverse social mix in prime areas, preventing them from becoming exclusive enclaves for the wealthy.

- Social Mobility: The PLH model supports the idea that hard work can lead to upward mobility, allowing families to aspire to live in prime locations regardless of their background.

For a more detailed breakdown of the benefits, you can take a look at our blog here.

What Kind Of "Privileges" Do You Need To Forgo If You Want To Qualify For The HDB PLH Model?

Compared to ordinary HDB BTOs, BTOs under the HDB PLH model come with additional restrictions, such as:

1. 10-Year MOP vs 5-Year MOP

The most significant restriction of the HDB PLH model is the 10-year Minimum Occupation Period (MOP), which is double the 5-year MOP for regular BTO flats. This extended MOP is a key feature of the PLH model, designed to discourage short-term flipping and promote owner-occupation. If you are thinking about upgrading to a condo or having more flexibility in your housing options, the long MOP might be a major drawback.

It's important to be prepared for the long-term commitment that comes with owning a PLH flat. Let's not forget that all BTOs take 3 to 5 years to build. This means that from the moment you commit to a PLH BTO, you may be tied to your home for the next 13 to 15 years, which can be a significant portion of your life.

2. Rental Restrictions Even After MOP Ends

In addition to the extended MOP period, the HDB PLH model also restricts homeowners from renting out the entire unit, even after the MOP is fulfilled. Unlike regular BTO flats, where you can rent out the whole unit after the MOP, PLH flat owners can only rent out individual rooms.

This restriction aims to maintain the PLH model's focus on owner-occupation and prevent it from being exploited for investment purposes. While this may reduce potential rental income, it's partially offset by the higher rental rates that rooms in prime locations can command.

3. Smaller Pool Of Buyers When You Are Selling Your Property

One potential drawback of the HDB PLH model is that it can result in a smaller pool of potential buyers when you eventually decide to sell your flat. This is because resale PLH flats are subject to the same eligibility criteria as BTO flats, including income ceilings and restrictions on private property ownership.

The biggest limitation is the income ceiling that your potential buyers will be restricted by. This could affect your bargaining power as a seller, as buyers might be unwilling or unable to pay a premium price for your PLH flat.

4. Reduction of Married Child Priority Scheme (MCPS)

Another difference between PLH flats and regular BTOs is the reduced quota for the Married Child Priority Scheme (MCPS). This scheme gives priority to married couples who wish to live near their parents.

For the PLH BTO launches, the quota for MCPS is generally lower, meaning it might be harder to secure a flat near your parents if you're applying for a PLH BTO. This is to ensure a wider distribution of these highly sought-after units.

How Much Additional Subsidies Are You Getting? And How Much Will Each Unit Cost?

Due to the higher market value of properties in prime locations, HDB provides additional subsidies to ensure affordability for homebuyers. However, HDB has opted not to disclose the exact amount of these additional subsidies.

Instead, the subsidies are factored into the indicative price range announced at the launch of each project. For instance, River Peaks I and II, the first BTO project under the HDB PLH model, has an after-subsidy price range of $582,000 to $688,000. Here’s a further comparison of the two projects:

| River Peaks I and II | Kent Heights | |

|---|---|---|

| Type of Property | 4-room | 4-room |

| Est. Floor Area | 88 sqm | 92 sqm |

| Est. Internal Floor Area | 86 sqm | 90 sqm |

| Price Range | $582,000 to $688,000 | $511,000 to $660,000 |

Source: HDB

A comparison of the November 2021 BTO pricing for Kent Heights (Kallang) and River Peaks (Rochor) reveals a similar price range. Considering that River Peaks is situated 1.5km closer to the CBD than Kent Heights, it appears that HDB has incorporated a substantial subsidy into the pricing.

Subsidy Recovery: The Unknown In The Equation

Unlike typical HDBs, HDBs under the PLH model will be subjected to a subsidy recovery (or subsidy clawback), affecting those who are looking to sell their HDB in the resale market.

Essentially, the PLH model dictates a subsidy clawback amount that needs to be repaid to HDB when you sell the property.

The rationale for this is:

- It ensures that those who benefitted from additional subsidies contribute back to the system when they sell their flats.

- It discourages speculative behaviour and prioritises homeownership for those who genuinely intend to live in the property.

The subsidy recovery amount varies from project to project, and is only made known when the BTO project is launched. Currently, River Peaks at Rochor is the only BTO project launched under the PLH model, with this project having a 6% subsidy recovery of the future selling price or valuation, whichever is higher.

This subsidy recovery policy is an important aspect of the PLH model, as it helps to moderate the potential windfall from selling these highly sought-after flats. Therefore, it’s important to understand this policy and factor it into your financial planning if you're considering buying a PLH flat.

What Are The Other BTO Flat Types Available Aside From The PLH Model?

Now that we've explored the ins and outs of the PLH model, let's take a look at the other BTO flat types available in Singapore. Understanding these different options can help you make a more informed decision about your housing needs and preferences:

- Standard Flats: These are the most common type of BTO flats, offering significant market discounts and flexibility in terms of location and eligibility. They are a good option for those seeking affordability and a wide range of choices.

- Plus Flats: Plus flats are located in more desirable areas with good connectivity and amenities. They come with additional subsidies to keep them affordable, but also have tighter resale and rental conditions compared to Standard flats.

- Prime Flats: Prime flats are situated in the choicest locations, offering the best connectivity, amenities and potential for value appreciation. However, they come with the highest subsidies and the strictest resale and rental restrictions, including a 10-year MOP and a subsidy recovery policy.

Comparing The PLH Model With Other Property Types

To gain a better understanding of the HDB PLH model, it's helpful to compare it with other property options available to Singaporeans. The following table compares the PLH model with normal BTOs, Resale Flats and Executive Condominiums (ECs) across key factors:

| Feature | PLH Model | Normal BTO | Resale Flat | Executive Condominium (EC) |

|---|---|---|---|---|

| MOP | 10 years | 5 years | Varies depending on previous owner's MOP | 5 years |

| Eligibility | Stricter criteria (income ceiling, citizenship, private property ownership) | Eligibility criteria for BTOs | Eligibility criteria for BTOs (with some exceptions) | Singapore Citizens and Permanent Residents |

| Locations | Prime locations (e.g., city center, GSW) | Various locations across Singapore | Various locations across Singapore | Typically located in more established areas |

| Price | Higher than standard BTOs due to location and subsidies | Varies widely based on location, age, and condition | Varies widely based on location, age, and condition | More expensive than BTOs but generally more affordable than private condos |

| Investment Opportunities | Limited rental income due to restrictions on renting out the whole unit | Potential for higher rental income, especially after MOP | Potential for higher rental income | Potential for higher rental income and capital appreciation |

| Resale Opportunities & Restrictions | Smaller pool of potential buyers due to stricter eligibility criteria. Subsidy recovery policy applies. | More flexible resale market with a wider pool of potential buyers. | Resale market subject to market conditions and HDB resale guidelines. | More flexible resale market, but subject to minimum occupation period (MOP) and eligibility criteria. |

Note: This table provides a general overview. Specific conditions and restrictions may vary.

Should I Choose The PLH Model?

The decision of whether to choose a PLH flat ultimately depends on your individual needs and priorities. If you're looking for a home in a prime location with a longer-term perspective and are comfortable with the restrictions, then the HDB PLH model could be a suitable choice. However, if you're primarily looking for investment opportunities or flexibility in renting out the entire unit, then a PLH flat might not be the best fit.

Ask yourself the important questions. Consider your long-term housing goals and whether you prioritise affordability, location or investment potential. If you're unsure which option is best for you, it's always advisable to consult with a housing expert or financial advisor to discuss your specific circumstances and make an informed decision.

Mortgage Master can also assist you with this process. We’re up-to-date on the latest home loan packages in the market, and can sometimes offer exclusive interest rate packages that you cannot get directly from the bank. So whether you want to know more about the PLH model, are looking for a BUC loan or even looking to refinance an existing loan, fill up our enquiry form and our mortgage specialists in Singapore will follow up with you.