- Home

- Blog

Popular & Trending

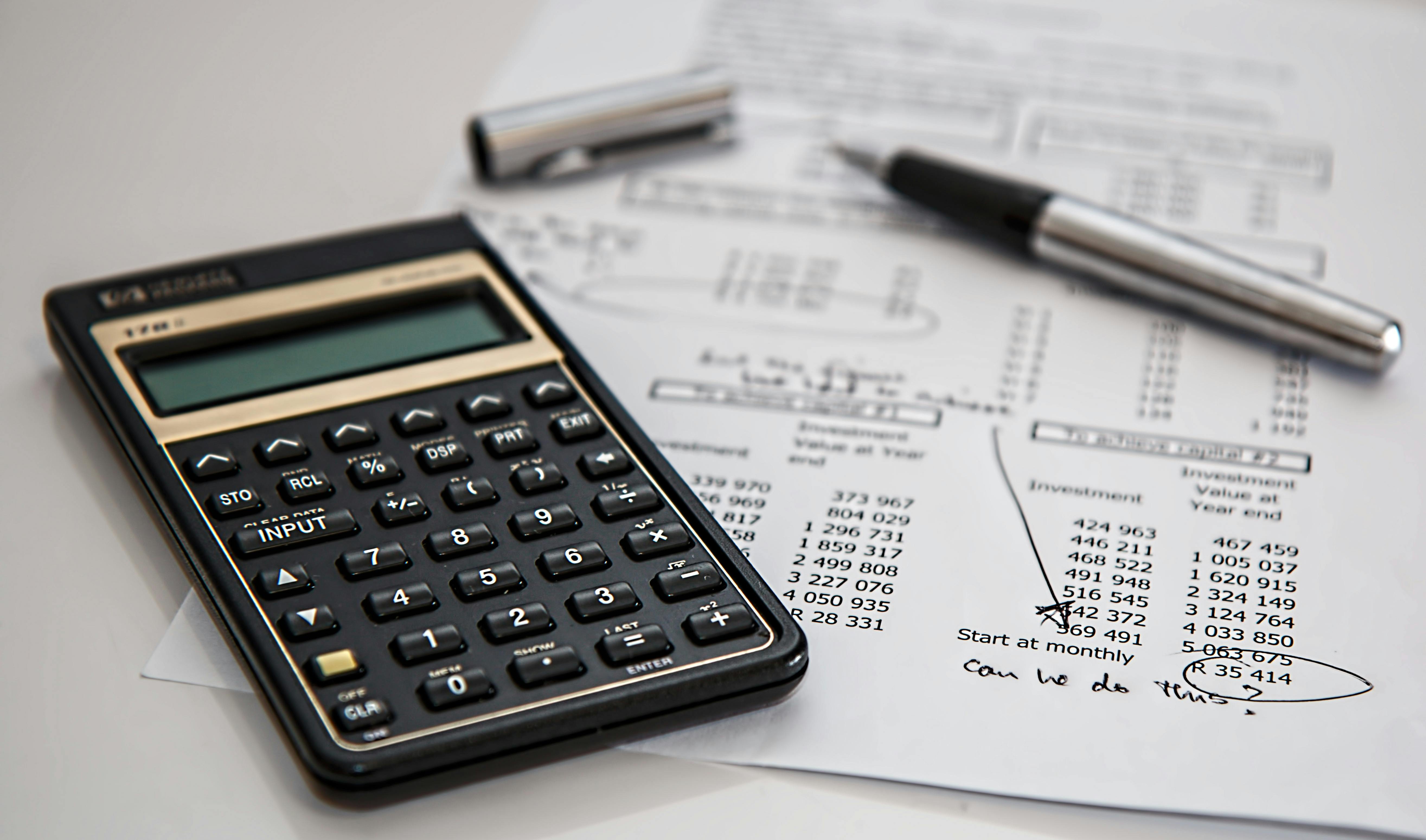

Discover the risks of unlicensed moneylending in Singapore and how to protect yourself. Learn legal options, safe borrowing, and financial literacy tips.

Learn why financial literacy is essential for every Singaporean. Discover how understanding mortgage loans and home loan interest rates can protect your financial future.

Discover why Singapore’s “super heartlands” — Bishan, Toa Payoh, Tampines, and Ang Mo Kio — outperform in property value growth and how this can help you choose the right mortgage in Singapore or refinance your home loan for long-term gains.

Article Categories

Our Articles

Will Singapore experience a recession in 2023? We share 5 points that new homebuyers will need to consider

The property market has defied all expectations, with valuations still at an all-time high despite higher interest rates. We ask why

BTO completion delays are nothing new in a post-pandemic Singapore, but a BTO launch delay? Well better late than never for the September 2023 BTO launch