- Home

- Blog

Popular & Trending

Discover the risks of unlicensed moneylending in Singapore and how to protect yourself. Learn legal options, safe borrowing, and financial literacy tips.

Learn why financial literacy is essential for every Singaporean. Discover how understanding mortgage loans and home loan interest rates can protect your financial future.

Discover why Singapore’s “super heartlands” — Bishan, Toa Payoh, Tampines, and Ang Mo Kio — outperform in property value growth and how this can help you choose the right mortgage in Singapore or refinance your home loan for long-term gains.

Article Categories

Our Articles

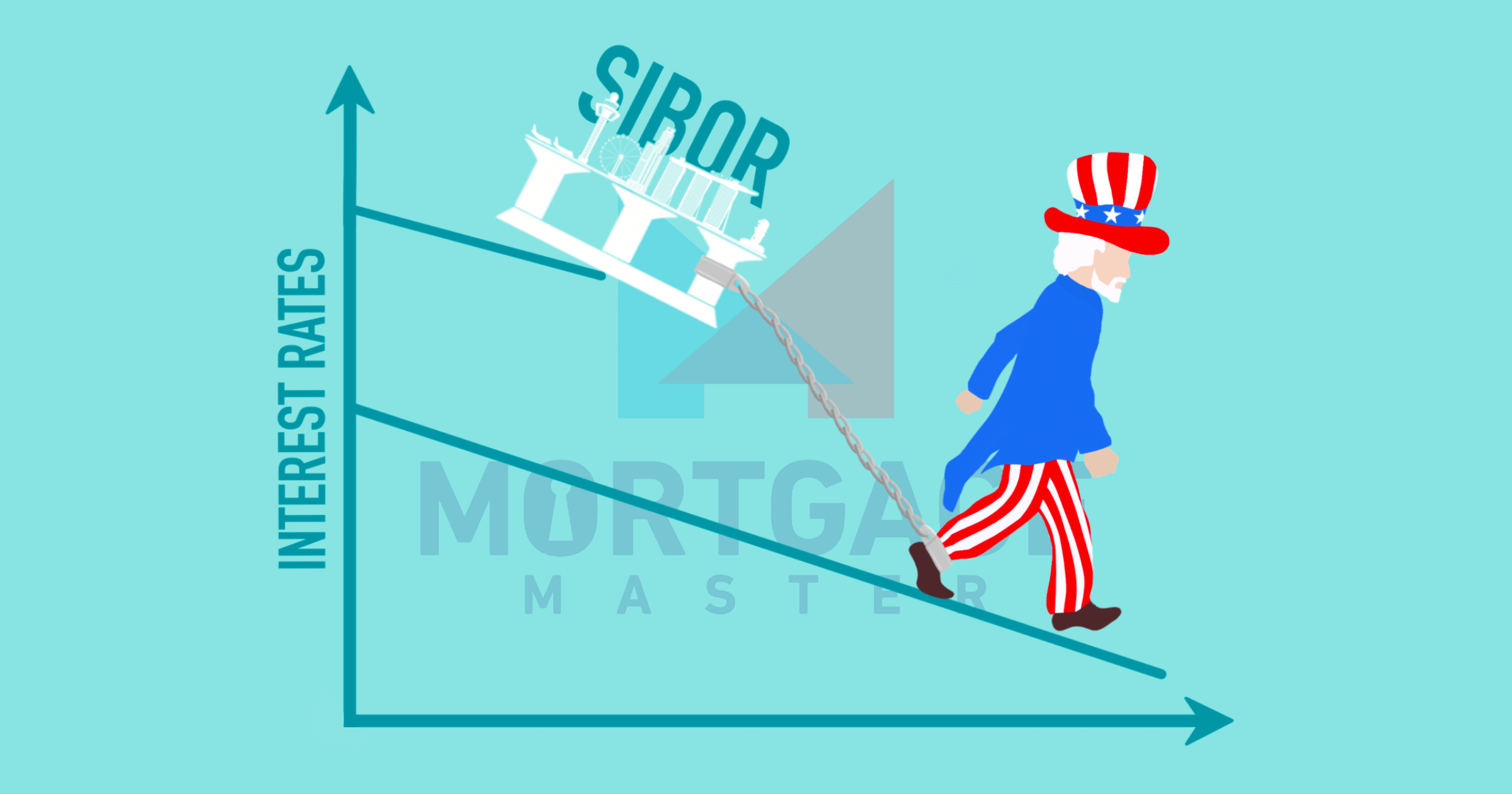

As SIBOR continues to fall in 2020, even the most risk adverse may find value in choosing this volatile type of home loan package. Here's why you should take a floating rate today.

On 31 March 2020, MAS announced a slew of financial relief measures for individuals, especially those affected by the COVID-19 pandemic and the economic downturn. So should you apply for mortgage deferment?

Before March 31 2020, banks were offering various relief measures to help homeowners during the COVID-19 pandemic. We compiled a list of 8 banks and financial institutions.

A board rate is a home loan interest rate that the bank determines internally. There is no transparency to you and me. How this rate is decided and what benchmarks are used are not revealed to the public. Read on to find out why you should avoid these home loan packages.

The Federal Reserve in the US cut interest rates again on 15 March 2020, the second emergency cut this year after dropping 0.5% on 3 March 2020. Even more surprising? The emergency rate cut of 1.0%, to a range of 0% - 0.25%.