- Home

- Blog

Popular & Trending

Discover the risks of unlicensed moneylending in Singapore and how to protect yourself. Learn legal options, safe borrowing, and financial literacy tips.

Learn why financial literacy is essential for every Singaporean. Discover how understanding mortgage loans and home loan interest rates can protect your financial future.

Discover why Singapore’s “super heartlands” — Bishan, Toa Payoh, Tampines, and Ang Mo Kio — outperform in property value growth and how this can help you choose the right mortgage in Singapore or refinance your home loan for long-term gains.

Article Categories

Our Articles

Find out why mortgage interest rates are skyrocketing in 2018 and what you can do to make sure your monthly instalment payment does not increase as well.

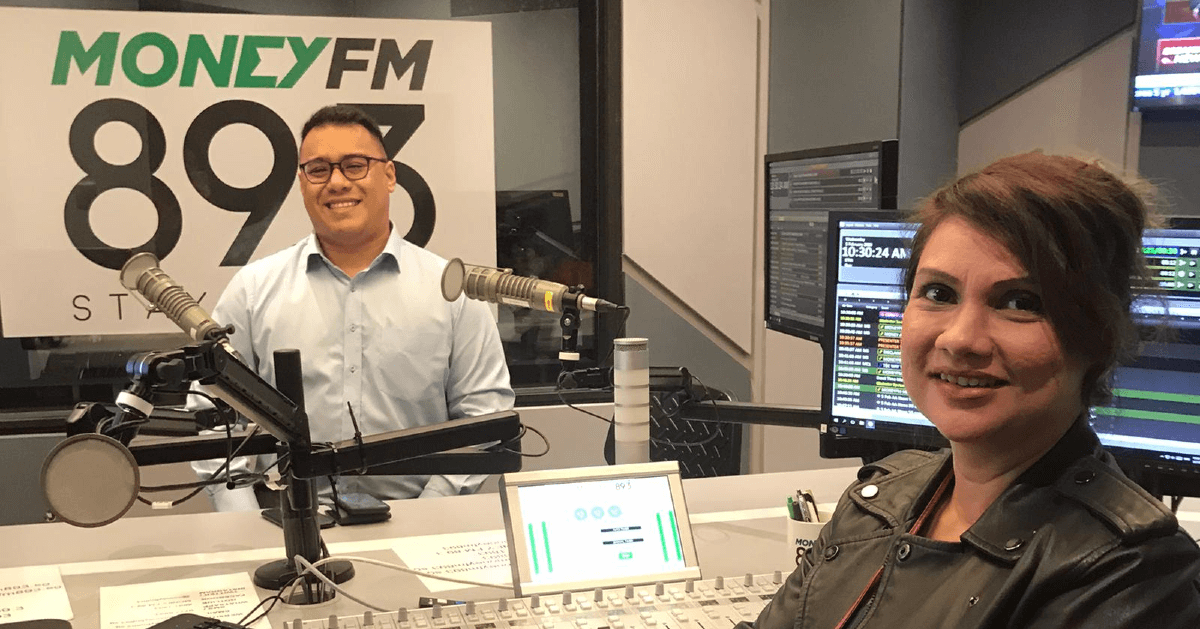

On 5 February 2020, Mortgage Master CEO David Baey was interviewed by Michelle Martin on Money FM 89.3 about choosing the best mortgage loan. Here is the interview transcript.

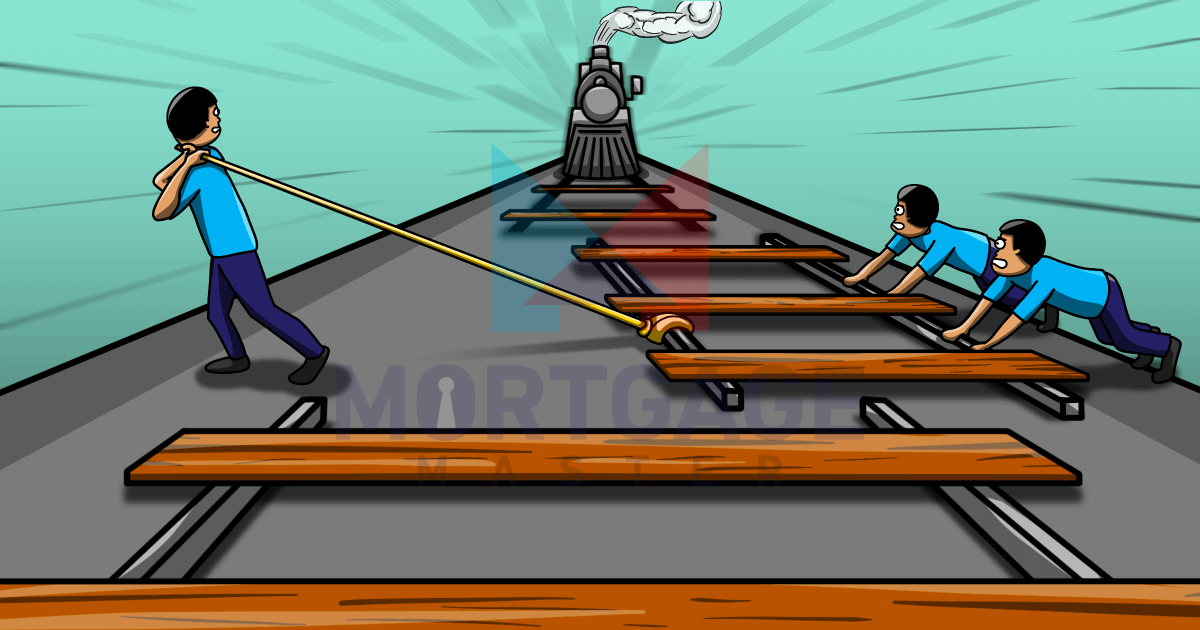

The mortgage market is like a train threatening to go off the rails. Left to their own devices, homeowners have to spend hours researching through multiple diverse home loan packages offered by several banks in Singapore, or they risk choosing poorly. Mortgage brokers are the solution.

Confused about mortgage loans and what they mean in Singapore? What is the meaning of fixed rate home loans or SIBOR? We help you make sense of home loan rates.

Ready to buy a house in Singapore? Don't forget to consider three things: whether to get an HDB loan or a bank loan, whether you can afford your downpayment, and if you have the ability to pay your home loan monthly instalments!

When one bank in Singapore announced they were raising their interest rate floor, the backlash was swift. But what is an interest rate floor and are banks allowed to raise it? I mean... it's supposed to be a FLOOR, right?

Are you buying an HDB flat in Singapore? Then you'll have to confront a perennial question. Is an HDB loan or bank loan better? What about for BTO? We weigh the pros and cons of each decision.

Should you choose a SIBOR rate for your housing loan in Singapore? What is the difference between 3 month SIBOR and 1 month SIBOR? Learn more about the Singapore Interbank Offered Rate and why it is so crucial to your mortgage.

For the past seven years, fixed deposit linked rates like DBS FHR6 have been a unique proposition in the mortgage industry. But are they truly as low a risk?

Depending your risk profile and financial situation, choosing fixed rate home loans may be the best choice. However, you have to consider that no package stays fixed forever, and that it may cost you more in the long run! Surprised? Here's what else you might not know about fixed rates in Singapore.