Anyone with a non-HDB mortgage would definitely know that their interest rates have risen dramatically in the past 5 years - from 1.1% back in 2011 to around 2% presently.

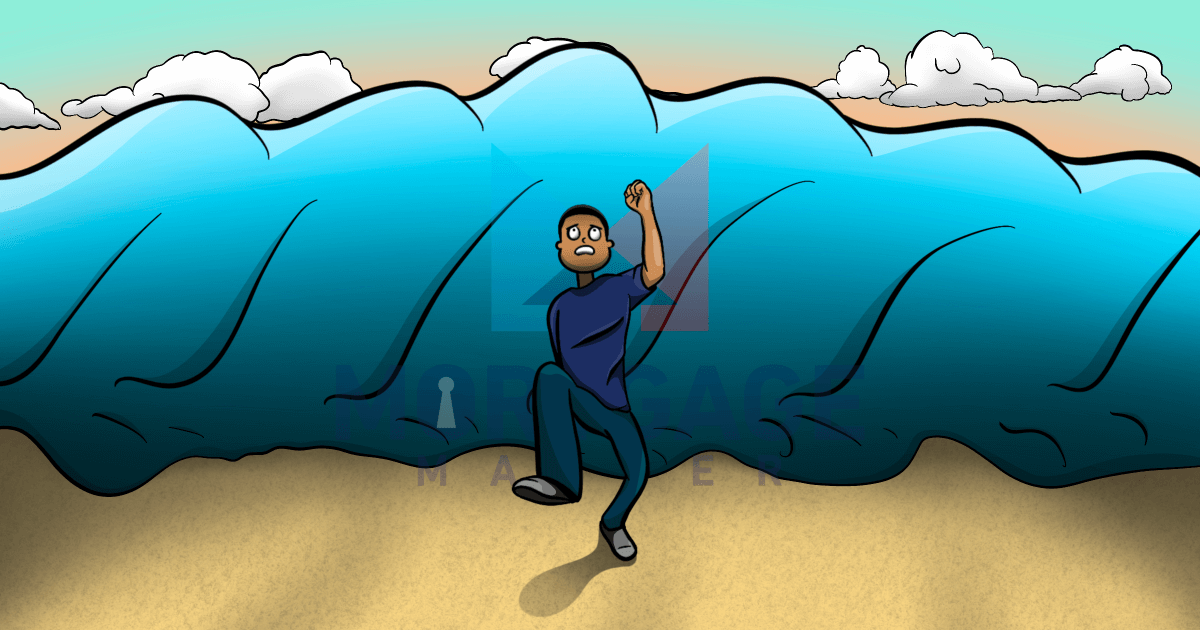

Unfortunately, as regular citizens with limited sway over the financial markets, we have no choice but to accept this rise. However, knowing why interest rates are rising may make us feel better and prepare us for the increasing financial commitments.

Global Economic Growth

The global economy has expanded since the 2007-2008 financial crisis, although global GDP has not yet reached the previous high in 2007. When there is massive economic growth, people get richer and have more money to spend. This will lead to high rates of inflation, meaning that your kopi-o is no longer just 90 cents but now $1.10. Ouch - that’s a crazy 22% increase in price.

One way to curb inflation is by raising interest rates. In recent times, the US Federal Reserve has also allowed its previously artificially-low interest rates to gradually rise, as the US economy has been gaining strength and no longer requires these low rates to boost consumption and investment.

As such, this is why interest rates are currently on the up and up, and will only start falling again during the next economic downturn.

How High Can Interest Rates Go?

Mortgage interest rates in Singapore have fluctuated between 1% and 8% over the past 20 years.

To take the most recent historical economic high as a gauge, people were paying around 4.5% in 2007.

What would this mean in the context of instalments? A $500,000 loan over 25 years would see monthly instalments increase from $2,120 (2%) to $2,780 (4.5%).

This works out to an increase of $660 a month or $7,920 a year.

What Can I Do?

(Rates correct as of 1st October 2018)

| Type | Transparent | Volatile | Lock-in Period | Risk | Interest Rates |

| SIBOR | Yes | Highest | Yes | Medium—High | ~ 1.76% |

| FD Linked | No | Low | Yes | Low | 1.88% |

| Board Rate | No | Sometimes | Yes | High | 1.8% |

| Fixed | Yes | NA | Yes | Low | 2.0% |

Understanding the risk involved in the rates that are available today is key to choosing the right mortgage package.

Should a mortgage be needed for the purchase of a new home, or if it makes sense to refinance, we recommend that you take the lowest risk rates rather than the lowest rates, in light of the current rising interest rate environment.

Remember: When it comes to mortgage rates, the lowest are often not the safest.

Not sure what to make of this information? Why not send Mortgage Master a WhatsApp message or fill up our enquiry form? Our mortgage specialists have been in the industry for years and can best advise you on the most suitable home loan packages in Singapore for your needs.