Popular & Trending

Learn why financial literacy is essential for every Singaporean. Discover how understanding mortgage loans and home loan interest rates can protect your financial future.

Discover why Singapore’s “super heartlands” — Bishan, Toa Payoh, Tampines, and Ang Mo Kio — outperform in property value growth and how this can help you choose the right mortgage in Singapore or refinance your home loan for long-term gains.

Celebrate National Day by refinancing your home loan and helping a low-income household. One loan disbursed = one essentials care pack donated.

Article Categories

Refinancing Articles

Wondering if mortgage rates in Singapore will drop in 2025? While experts predict a gradual decline, the timeline remains uncertain. With fixed rates currently lower than floating rates, is now the right time to lock in a loan? This article breaks down interest rate trends, expert forecasts, and the best refinancing strategies for homeowners. Read on to make the smartest mortgage decision in 2025!

Looking for the best home loan in Singapore? This guide compares fixed vs floating rate home loans, breaking down their pros and cons, who they are best suited for, and how to choose the right mortgage in 2025. Whether you're buying a new launch condo or refinancing, find out which loan type will save you the most money. Read now to make an informed decision!

Singapore's core inflation has risen to 5.3%, coming close to the 14-year high of 5.5%. How can refinancing our home loan help with inflation?

You may have your reasons why you do not want to refinance your home loan in 2022, but if they are one of these five, then here are some tips for you.

Saving money in Singapore isn't just about giving up luxuries. Sometimes it's about making smart financial decisions for the things you can't avoid in life.

Why should you care about refinancing? Kyler Q. the Mortgage Noob answers this most important question in the second article of his What Are They series

It is definitely a good idea to refinance your housing loan in Singapore. The main reason is to save money in the long run, but you can also enjoy other benefits offered by the banks! However, take the time to learn more about the fees and costs involved in refinancing before you make your decision.

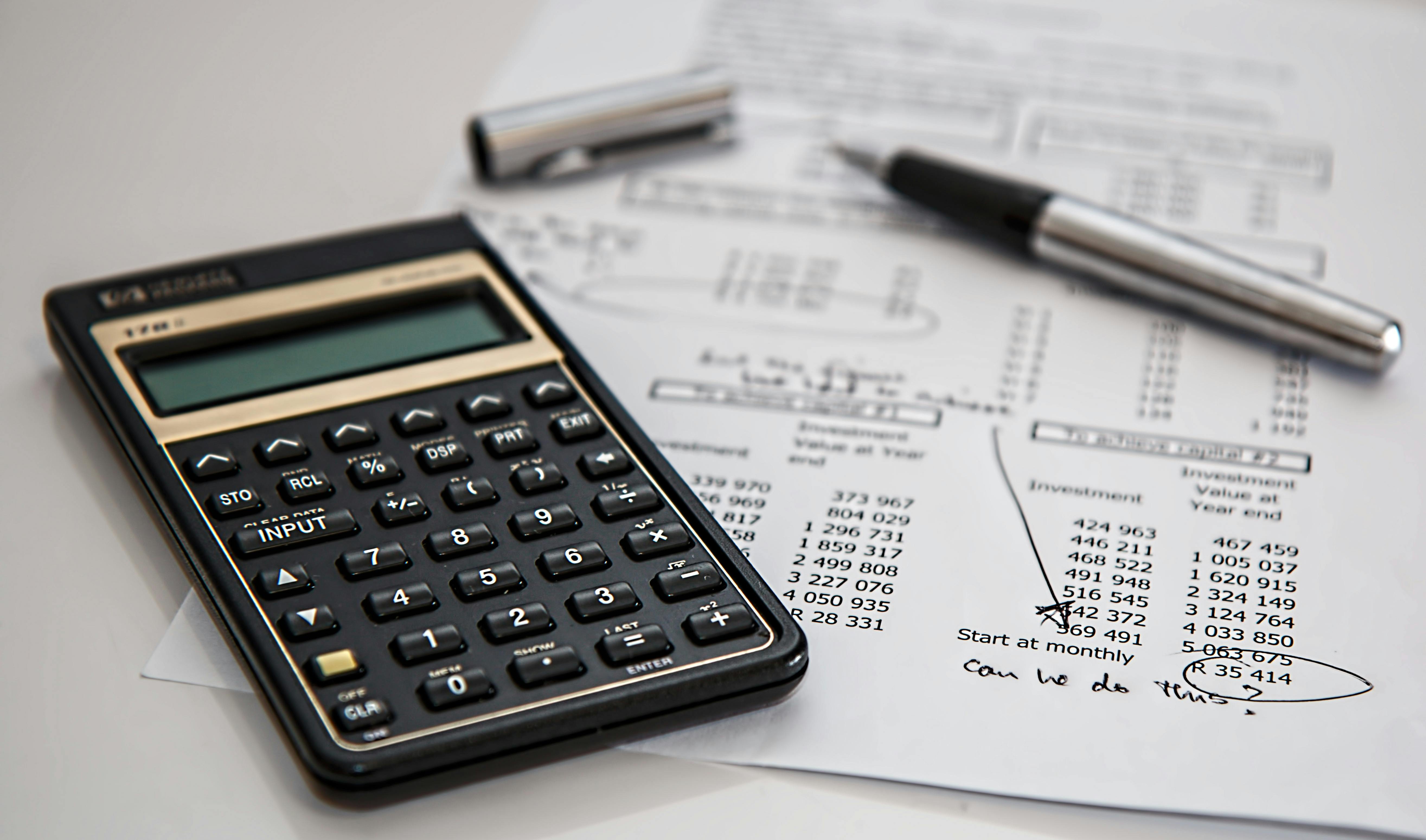

DBS has announced two unique 5 year fixed rate packages, but which one is better for HDB owners looking to refinance? We did the math so that you don't have to.