Welcome everyone, to a new series offering explanations on concepts/ideas/terms that are used in the property industry, by an intern with zero background in the property industry. Yep, you read that right.

In this series, I’ll be doing my best to explain these complex terms as simply as I can so that you can best understand it too. If you’re keen on learning more about the property industry, let’s go on this journey together. Welcome to the What Are They (WAT) series, by the Mortgage Noob in Mortgage Master.

Foreword from author:

Hey good lookin’, hope you’re having a fine day today. Full disclaimer for this article, this is to serve as a brief introduction to the basics of Refinancing - the 5 Ws and 1 H. Just like everything else in life, it has its pros and cons. In this article, I mostly just describe what refinancing can do. I'll probably only talk about the costs of refinancing in the future (probably along with repricing?), we'll see. Till then, enjoy the article. Mad love, take care, be a good person.

Honestly, if you’re not on a home loan and/or you don’t see yourself taking one in the near future .. there’s really no need for you to read this now apart from your own curiosity and inquisitiveness, but I’ll see you in a few years when you’re ready.

For the rest of you, ESPECIALLY those who’re in your 20s, those in relationships and your partner is pressuring you to BTO, and those who have never seen the word ‘refinancing’ before,

Y'all better stay here, I'M DOING THIS FOR YOUR OWN GOOD!! (exactly what my dad said before caning me sighhhh, still love u tho <3)

What is Refinancing

If you’re being financed, it means you’re currently taking a loan

If you refinance, it means you’re replacing that loan with a new one (yeah, you can do that!)

Think of it this way. If you’re a fresh grad and you’re broke and having instant noodles constantly in a period of your life, you’ve probably thought of becoming a sugar baby (totally not using myself as an example btw)

If you get money from your sugar daddies/mommies, you’re being financed. Refinancing is basically changing your sugar daddy/mommy because someone else is better (more $ .. less demands .. better looking .. take your pick)

Similarly, when it comes to housing loans, why wouldn’t you go for the better option when it arises?

How Refinancing works

The concept of refinancing exists because you can get lower interest rates.

People just need to be aware that it exists.

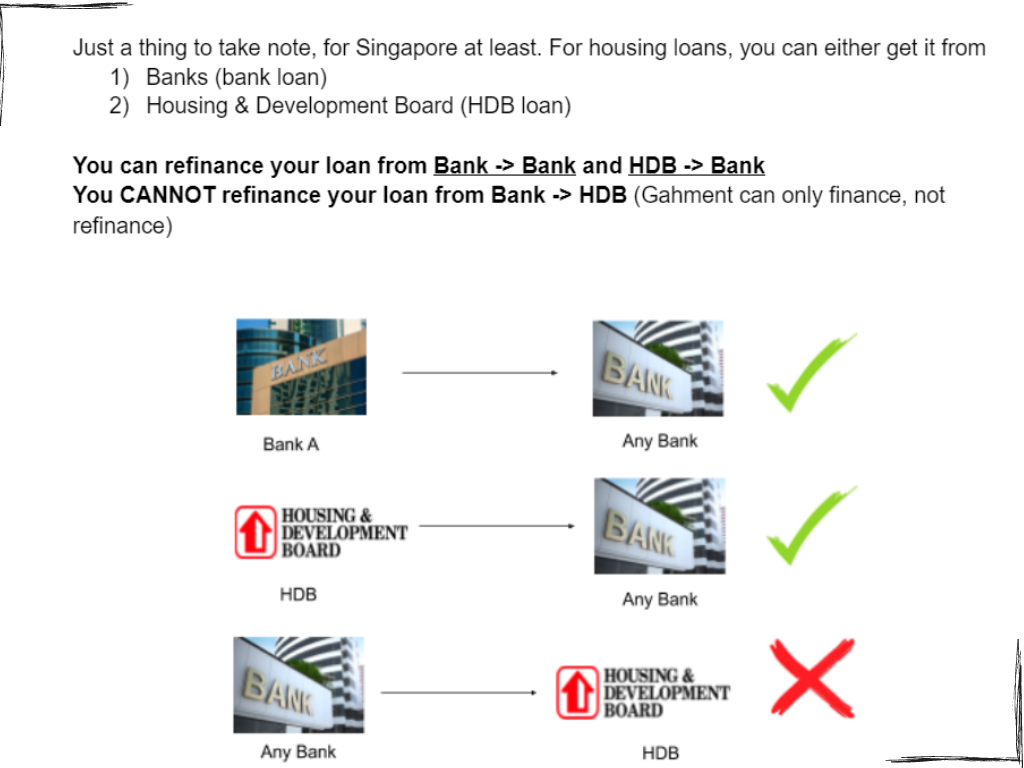

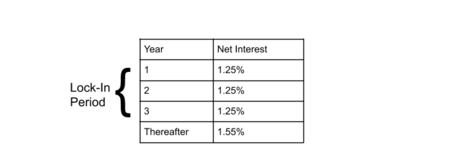

For context, this is what a housing loan looks like. Of course, this is just a partial image, but it’s what we require for now.

The idea of Refinancing is basically you enjoying that 1.25% interest rate for 3 years from bank A, then before the 1.55% kicks in, you refinance your loan with bank B so you avoid that higher interest rate.

That's the sweet spot.

Just a casual reminder that Refinancing is to Replace, not add.

(I say this because the first time I heard it, my stupid brain processed it as adding a new loan)

Keep in mind though, your new loan might not be as low as the 1.25%, but the main goal is to find a loan <1.55% so that you would not have to pay as much.

If you’re still a bit confused,

Y’all remember how years ago when Spotify was ‘new’ and we all had the promotion of “99¢ for 3 months”?

But, if you didn’t cancel your subscription by the end, it would then start charging you the usual fee of $9.99/month?

So you had a few options,

A. Start to pay $9.99/month

- Sticking to your original loanB. Look for cheaper options such as Apple Music/

Youtube-Downloader

(i mean whutttttt ... psshh .. downloading illegally is bad guys … )

- RefinancingC. Sticking to spotify but getting a cheaper deal (Eg. Family plan)

- Repricing (I will cover this in another article)

Similar to housing loans, you’ll pay a certain amount for the initial period. After that, you’ll start paying more.

If you refinance into a new loan that has a lower interest rate, that means you have to pay less interest, that’s how refinancing = saving money

Additionally, refinancing exists because banks want you as their customers.

It’s really that simple lol.

Every bank wants to earn your interest when you take a loan.

So, in the ever-competitive banking scene, there are always new promotions/packages/rates to attract customers. Thus, in their own battle of trying to win customers, you directly reap the benefits such as lower interest rates.

Yet, many people lose out on being able to save on their loan payment simply because they’ve never heard of refinancing (like me 2 weeks ago) or they don’t know how to go about it.

So,

- Current homeowners: Please check if you’re eligible for a refinance now (Brother Covid providing with the low interest rates la). Just contact any mortgage brokerage if you need a quick run-through of the current packages banks are offering.

- Future/Soon-to-be homeowners: Please know that ‘Refinancing’ is an option you have to keep in mind. Just because you’ve got your house, doesn’t mean it’s over. You’re able to save money!!

Why should you Refinance?

Before I go into the most crucial section, when to refinance, you should first understand why you should even consider refinancing.

At its core, the ONLY reason you should refinance is because it’s cheaper, and it saves you money.

- As mentioned, you’re already most likely bound to pay a higher interest rate once you’ve reached your ‘thereafter rate’ after 2-3 years. So, why are you staying in that loan when banks are always marketing new promotions with lower interest rates to attract customers?

When is the best time to Refinance?

Banks also know we Singaporeans are very kiamsiap, that’s why you can’t just simply refinance whenever you spot a lower interest rate (this one not Value $ shop where the ‘Fire Sale!!’ had been going on for the past 12 years)

How they prevent this is whenever you take any mortgage loan (could be your 1st or even your 5th), there will be a Lock-In Period.

Lock-in period = the time you’ll need to stay in that loan contract, without paying a penalty fee

It’s essentially the same as your phone contract

In your 24-month phone contract, the “lock-in period” should be about 22 months (because they’ll always let you re-contract 2 months earlier).If you decide to leave within the 22 months, you’ll have to pay a termination fee.

This is the same for your housing loan.

For housing loans, the typical lock-in period is 2-3 years. So, within this period, if you decide to refinance into another loan, you'll have to pay a termination fee.

Try not to look at these 2-3 years as anchors that will weigh you down, but look at it as having a chance to zao from the high interest rate to see if there’s a better deal out there every 2-3 years.

AND .. if there IS a better deal, refinance and save money!!

Best time to Refinance

The ideal time you should start scouting for refinancing plans is 3 months prior to your lock-in period ending.

- For example;

You signed a loan in June 2020, and the lock-in period is for 2 years, this means you should start looking out to refinance your home around March 2022.

This is because your initial interest rate is ending, and you have some grace period to scout for potential refinancing plans, before your THEREAFTER RATE(!!!) starts.

BUT ..

whether you SHOULD do it every 2-3 years or not is an entirely different question.

Just because you see it, doesn’t mean you just go and grab it (ahem uni chi-ko-peks)

Should you refinance every 2-3 years?

(For my fellow noobs, I know there might be some unfamiliar terms such as SIBOR and Repricing. Don't worry about this first, all you need to know is that these variables affect what kind of packages banks roll out.)

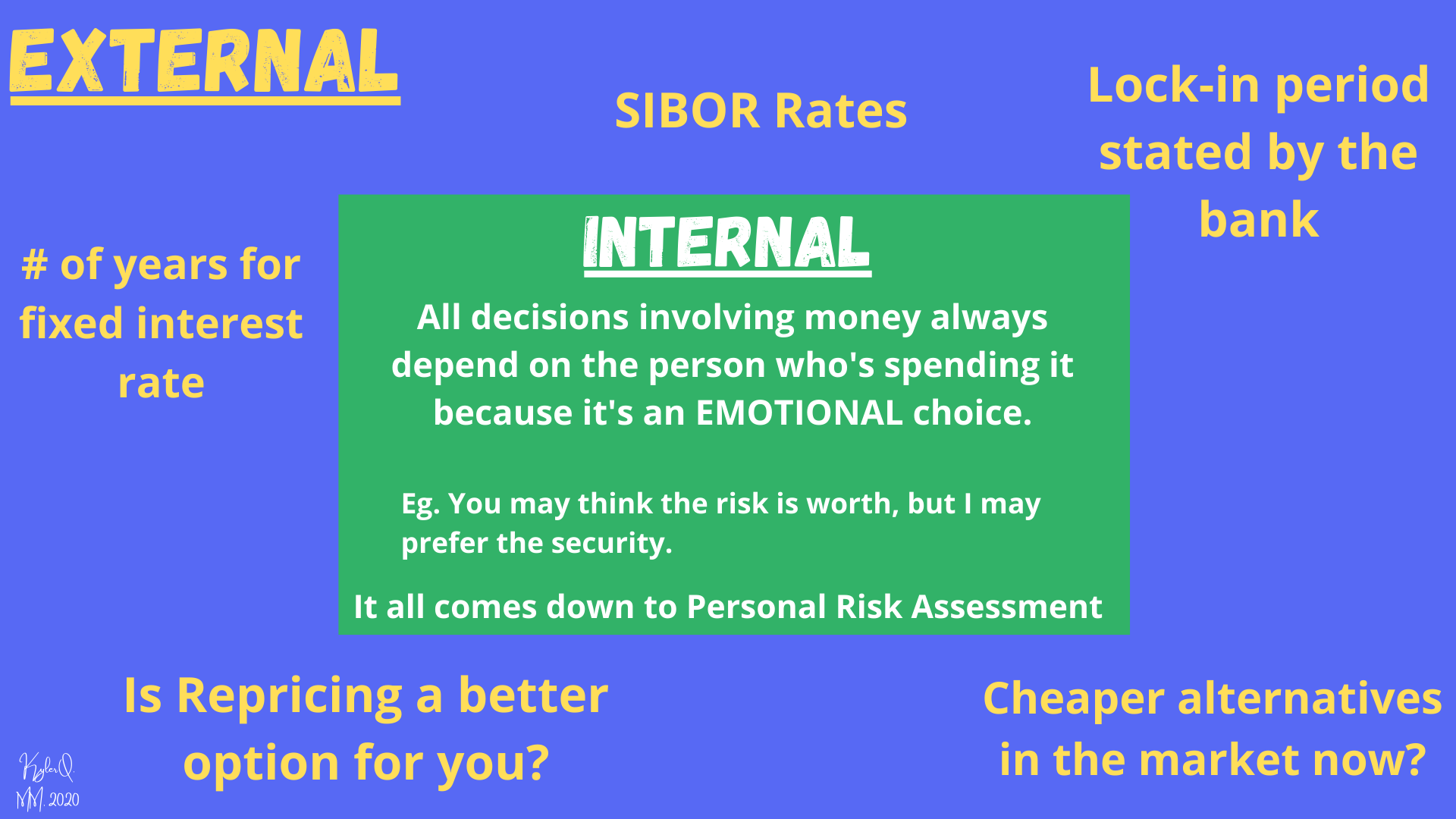

Your decision to refinance can be separated into Internal and External factors.

Internal refers to how you’re feeling inside ( …. duh).

But more so, how you’re feeling specifically at that period when you’re looking to refinance

- Perhaps, financial security might not be as strong that period, and you’re hesitant about making decisions that involve bigger loans.

External refers to factors that are mostly out of your control.

Because the rate will be determined by what the bank puts out, you have no choice but to just sit there lan lan and hope it goes in your favour.

- For example, if your lock-in period is ending but interest rates at that time are very high, and if you’re already on a decent interest rate for your loan, then there’s no need to refinance.

So, it’s really not that simple where you just stare at the numbers like how your parents do at the TV when they’re checking their 4D.

If you’re a person who has Luck+100 in your stats and you get super lucky with rates, you can save aloooooooot of money (those who refinanced into a SIBOR rate just before covid hit, i’m so envious).

But if you’re like me, who has 0 luck, what can you do?

Mortgage Master doesn’t just use Luck, we use Int

If the course of refinancing depends so much on external factors, why do you even need a mortgage broker to help you?

Simple …. It’s because you’re lazy, and it’s our jobs (well .. not mine, my fellow colleagues', I’m just on google docs).

Mortgage brokers can’t force you to refinance, but we can advise you.

Banks come up with new promotions very often (every 2-3 weeks?) and mortgage brokers are the first in line to receive all this information.

Not only can we be your guides in current interest rates, but we can also help to answer any queries you may have regarding your thoughts of refinancing - whether you should do it or not, how much you may save etc..

1. Do I need to refinance?

2. Should I even refinance at all?

3. Will I save money if I refinance now? Or should I do it next year?

4. Should I get fish or chicken for dinner?

5. I would like to know more information about refinancing

So please, from person to person, no marketing here because I genuinely want to offer a piece of financial advice, I implore you to make a mental note of Refinancing.

Feel free to contact any mortgage broker if you need assistance, but if you decide to choose Mortgage Master, you’ll also get a rebate if your refinance is successful (you literally get money for saving money) (this one got abit marketing heh)

At the end of the day, don’t feel FOMO if you haven’t heard of refinancing. Hopefully, I’ve managed to provide some clarity and understanding to what refinancing really is, and how it can be beneficial for you.

Having said that, I would just like to reiterate that this article mostly serves as an introductory to Refinancing, and might have come off something like "dude refinancing is honestly the best thing", but as I mentioned in my foreword, there are costs (literally) to refinancing too, which I'll go into more detail in my future Repricing article. future Kyler pls rmb to hyperlink this I got you past Kyler

If you’re looking for a more intermediate-level guide, something more concise, something with numbers as examples (if that’s your thing), check out my fellow writer (actually is boss la), Peter’s, article about refinancing.

Even if you forgot most of what I’ve said (it’s a long article I don’t blame you), I’m more than satisfied as long as you’ve learnt 1 key point from this.

Just remember, refinancing is like life.

You’re a precious, beautiful gem, don’t settle for less when that someone better comes.

Have a beautiful day y’all.

Xp gained today: 66 (R=18, E=5, F= 6, I=9, N=14, A=1, N=14, C= 3, E=5)

Status: Lvl 1 Beginner

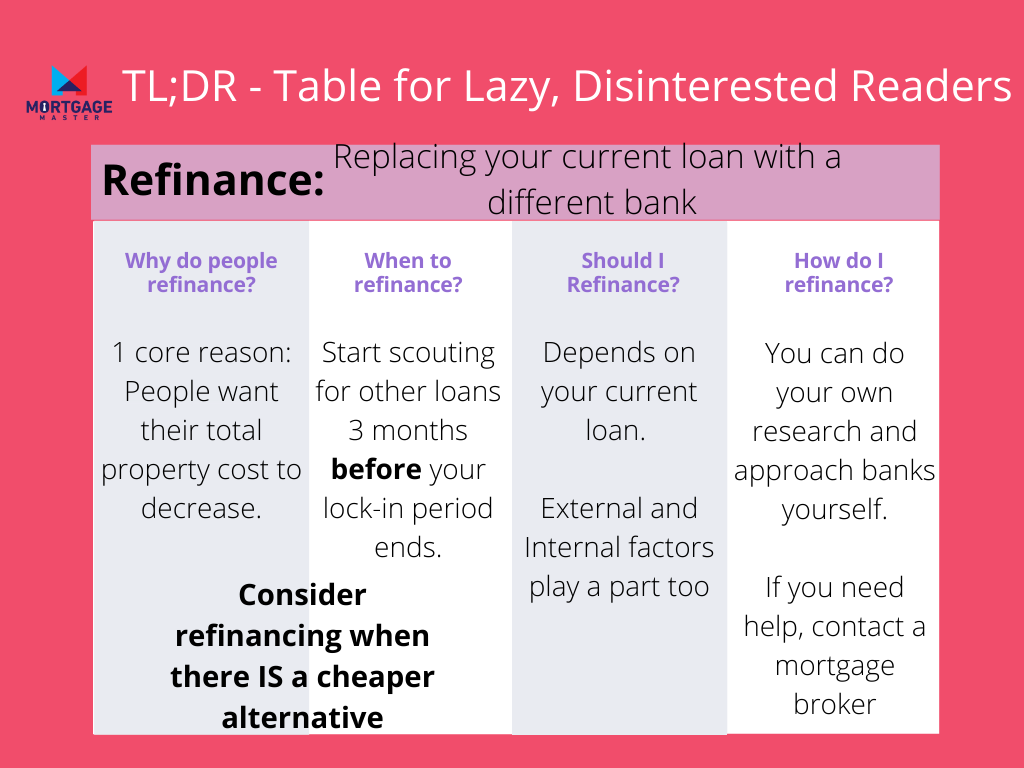

TL;DR,

More in the WAT series

What are mortgage brokers and what the hell do they do? (WAT #1)