Popular & Trending

Learn why financial literacy is essential for every Singaporean. Discover how understanding mortgage loans and home loan interest rates can protect your financial future.

Discover why Singapore’s “super heartlands” — Bishan, Toa Payoh, Tampines, and Ang Mo Kio — outperform in property value growth and how this can help you choose the right mortgage in Singapore or refinance your home loan for long-term gains.

Celebrate National Day by refinancing your home loan and helping a low-income household. One loan disbursed = one essentials care pack donated.

Article Categories

Interest Rates Articles

Wondering if mortgage rates in Singapore will drop in 2025? While experts predict a gradual decline, the timeline remains uncertain. With fixed rates currently lower than floating rates, is now the right time to lock in a loan? This article breaks down interest rate trends, expert forecasts, and the best refinancing strategies for homeowners. Read on to make the smartest mortgage decision in 2025!

Looking for the best home loan in Singapore? This guide compares fixed vs floating rate home loans, breaking down their pros and cons, who they are best suited for, and how to choose the right mortgage in 2025. Whether you're buying a new launch condo or refinancing, find out which loan type will save you the most money. Read now to make an informed decision!

Looking to buy a new launch condo in Singapore? This guide breaks down the latest condo prices, minimum income needed, and monthly mortgage payments for upcoming new launch SG projects in 2025. Find out if you can afford top developments like Parktown Residences, Arina East Residences, and The Orie, and get expert mortgage advice to secure the best home loan. Read now to plan your purchase wisely!

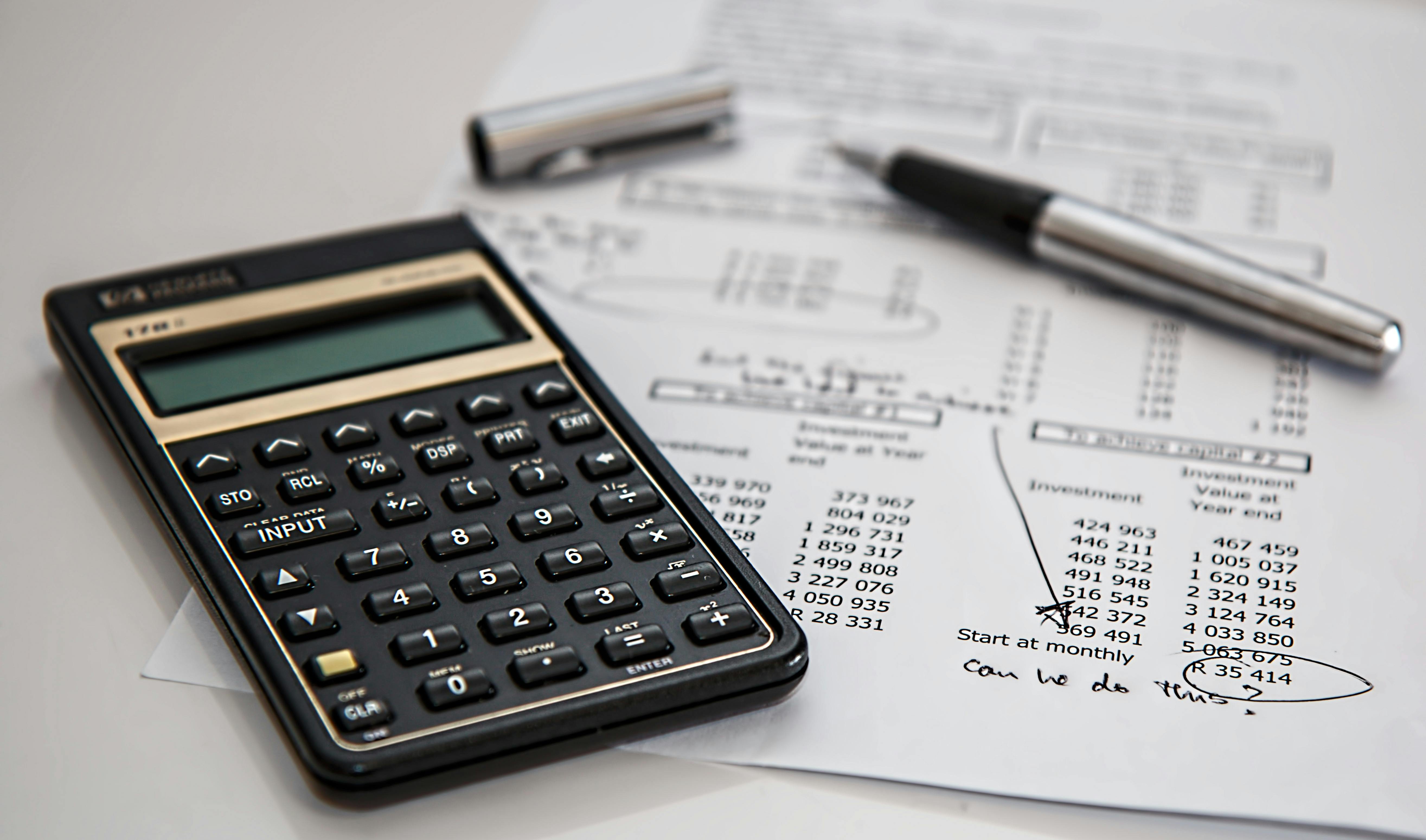

Learn how to calculate mortgage loan interest in Singapore. Find out about amortisation, factors affecting rates, & use our calculator to estimate costs.

Comparing Parktown Residences and Aurelle EC? This guide breaks down pricing, location, payment schemes, and buyer eligibility to help you choose the best Tampines new launch for your needs.