Property prices in Singapore have been heating up in the past two years, despite (or because of?) the COVID-19 pandemic. In fact, private property prices in Singapore jumped by 10.6% in 2021 alone. HDB prices also showed a similar vigour in the same year with prices popping by 12.7% in 2021.

While property prices have been rising, the phenomenon of negative cash sales has also been on the rise. But what exactly is a negative cash sale and how does it affect the homeowner? As a homeowner, what can you do to mitigate the likelihood of a negative cash sale?

What Is A Negative Cash Sale?

Negative cash sale is a term used to describe any resale property transaction that is NOT able to cover the accrued interest from using your CPF Ordinary Account (OA).

First, remember that your funds in your CPF Ordinary Account would normally accrue interest at the CPF OA rate of 2.5% p.a. If you are using your CPF OA to pay for your home mortgage, you will need to first "repay" your OA when you sell your property. That means the accrued interest (along with the CPF OA principal amount you withdrew) needs to be topped up into your CPF OA.

(The funds in your CPF accounts are still your money in the end, so you're essentially returning the money to yourself!)

If you are unable to make the top up into your CPF OA along with the accrued interest, it means that you have made a negative cash sale on your property.

Now, despite the word "negative", a negative cash sale isn't necessarily bad. It doesn't even mean that you have made a loss when you sold your property. On the contrary, there is a possibility of making a negative cash sale even when you have sold your property for a profit!

For example, you sell your 5-room flat in Toa Payoh for $880,000. Congratulations!

Assume you still have $400,000 outstanding on your loan, so after paying that off, you've still got $480,000 left. Not too bad, right?

However, according to your CPF Property Withdrawal Statement you have used a total of $500,000 from your CPF OA - principal amount and accrued interest combined.

That's because you've used your CPF OA to pay for your downpayment, stamp duties and legal fees, even your Home Protection Scheme payment! And since the time you bought your house, that amount has accrued interest at a rate of 2.5% p.a.

You therefore have a negative cash sale, since the amount you have to "repay" your OA is more than the proceeds of the sale.

Fortunately, if you have sold your flat at or above market value, you don't have to top up the difference. It just means the remaining $480,000 from your sale goes straight to your OA.

How Does Negative Cash Sales Affect Homeowners?

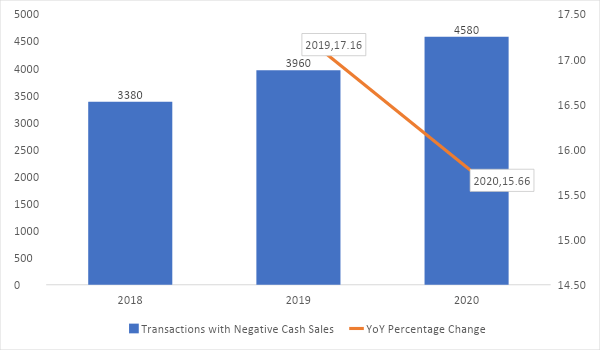

Based on figures released by CPF, the number of homeowners who made a negative cash sale has been increasing between 2018 and 2020. The increase is between 15% to 17% year-on-year.

Source: CPF

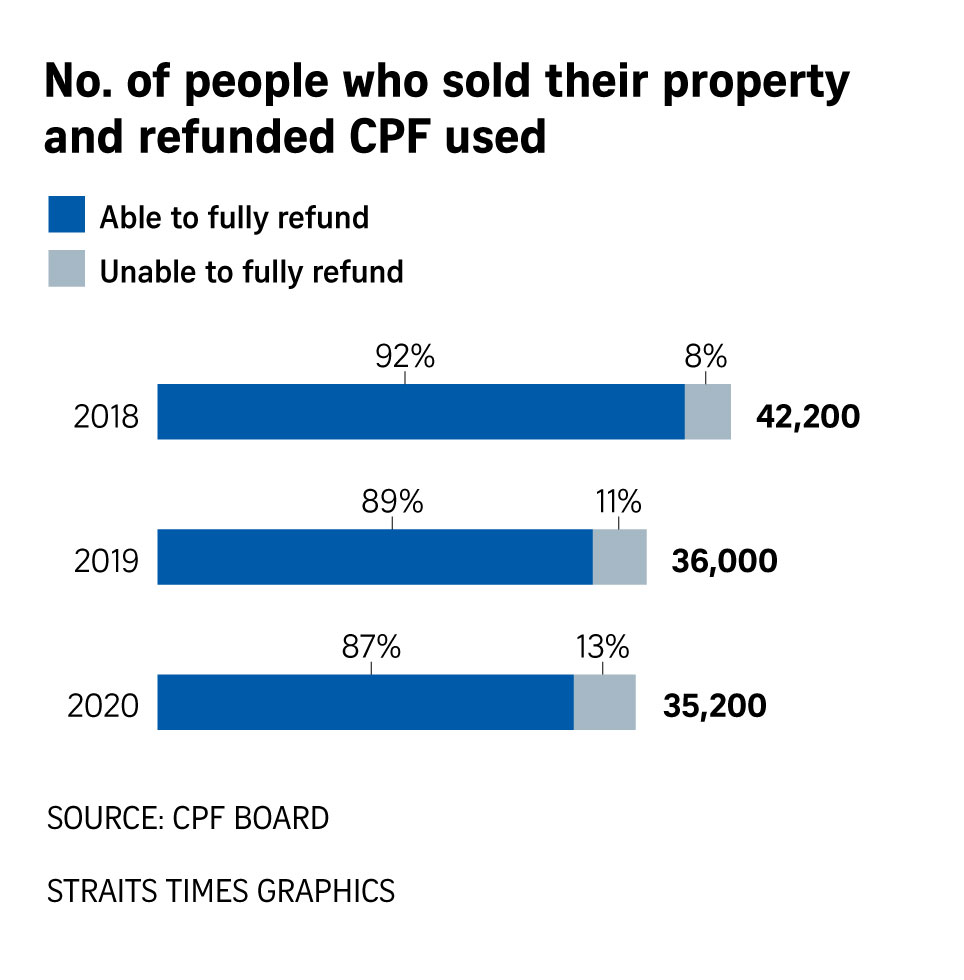

In addition, the proportion of homeowners who sold their property but were unable to fully refund the CPF OA money used due to negative cash sales rose by around 200 to 300 basis points (bp) every year.

Source: The Straits Times

Source: The Straits Times

Why Is There A Growing Trend Of Negative Cash Sales?

Those who sold their properties may have realised some paper gains. However, the reality is that those gains were not enough to cover the higher transaction cost from legal charges, stamp duties and other fees.

If you had a negative cash sale, it means that your property was appreciating at a pace slower than 2.5% p.a. In other words, negative cash sales mean that your money would have grown at a faster pace if they were kept in the CPF OA.

The growing trend of negative cash sales is one that existing and new homeowners need to grapple with and be wary of. There are various reasons for rising number of negative cash sales transactions including:

- Slower pace of asset appreciation

- Higher asset price when the property was bought

- Property sold at a loss or below market value

In particular, homeowners need to be wary of the slower asset appreciation rate. This is especially since the asset growth rate is slower than CPF accrued interest rate. It is an early warning to homeowners who are expecting the same kind of “profit” from property that our parents had enjoyed.

How To Mitigate Negative Cash Sales?

While the slowing rate of asset appreciation is something that is beyond your control, there are some ways that you can help mitigate the likelihood of having a negative cash sales at the time when you are selling your property.

One way is to avoid overpaying for a property. Overpaying at a higher valuation for your property means that you need to take out a larger loan, resulting in more accrued interest from CPF.

The other way to mitigate the possibility of a negative cash sales is to be smart about how you refinance your property. If you are able to finance your property with as low interest rate as possible, it will help you avoid overpaying on your interest payment. This means that you will use less of your CPF OA money for your mortgage, leading to lower accrued interest with CPF.

The best part about smart refinancing is that it isn’t hard at all. Neither is it rocket science to figure it out. All you need to do is to compare the interest rate from various home loan providers on a quick comparison calculator here. You can also engage a mortgage broker like Mortgage Master to help you find and lock in home loans at promotional interest rate with the banks. Getting the lowest interest will help you reduce the cost of financing property. When your home loan lock in period is up, Mortgage Master’s friendly mortgage brokers will also remind you to refinance to a cheaper home loan rate.

At Mortgage Master, we know the latest home loan packages in the market and sometimes can even offer exclusive interest rate packages that you cannot get directly from the bank. If you're looking to purchase a new property, or refinance your existing home loan, fill up our enquiry form and our mortgage consultants will follow up with a call.