“Potentially the greatest BTO sale in the past 8 years”

New year, new system.

To help you better compare between the different sales in this launch, we’re introducing a new ranking system.

⭐⭐⭐⭐⭐ = good

⭐ = not as good

Sure, it’s a bit subjective, but aren’t all BTO guides subjective anyway?

Oh btw, don't you know you stand a ✨better chance at securing a BTO ✨if you subscribed to our telegram channel? (for legal reasons, i'm joking)

Prepare your Singpasses, whip out your $10 and put on your reading glasses, cause it’s BTO time again baby.

Guides for the other sites in this launch,

Content Page

Kallang/Whampoa Feb'22

Units Available

Price & Affordability

Transport

Education

Amenities

How much can you earn if you sell this BTO?

Kallang/Whampoa Feb’22

Potentially the sale that will not only be the most sought after in this Feb’22 launch, but maybe in the past 8 years?

Last November, I was fanboying over the Rochor BTO, with the only caveat being the restrictions of the PLH Model (cause who doesn’t want free money from the gov?)

But remove those restrictions while having everything else the same??

That’s what this BTO is.

Honestly, Rochor walked so this Kallang BTO sale could run.

So ... HDB just loves to rain on the parade huh.

This Kallang BTO seemed too good to be true, having all the amenities the Rochor one had, without the PLH restrictions.

But alas, the announcement that this Kallang BTO is also under the PLH model dropped like grapes and shocked applicants (and a certain BTO guide writer).

Guess we should have seen it coming.

BTO Name Prediction:

Lavender Breeze / Lavender Heights / Lavender Axis

Actual name: King George's Heights

Units Available

Only 398 units are available, consisting of both 3 & 4-rm flats.

FYI; Application rate for the Rochor BTO was 3.1/10.3 for 3/4rm respectively.

This one is gonna surpass that imo.

Find out more: The different types of houses in Singapore

Price & Affordability

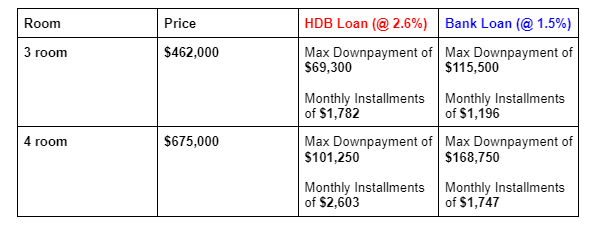

Price Table

Mortgage Breakdown

Prices used were the highest amount predicted

15% Downpayment was used for HDB loans, for a max of 25 years

25% Downpayment was used for Bank loans, for a max of 30 years

Bank loans were excluded for 2-rm flexis since banks don't commonly finance 2-rms

Back to top

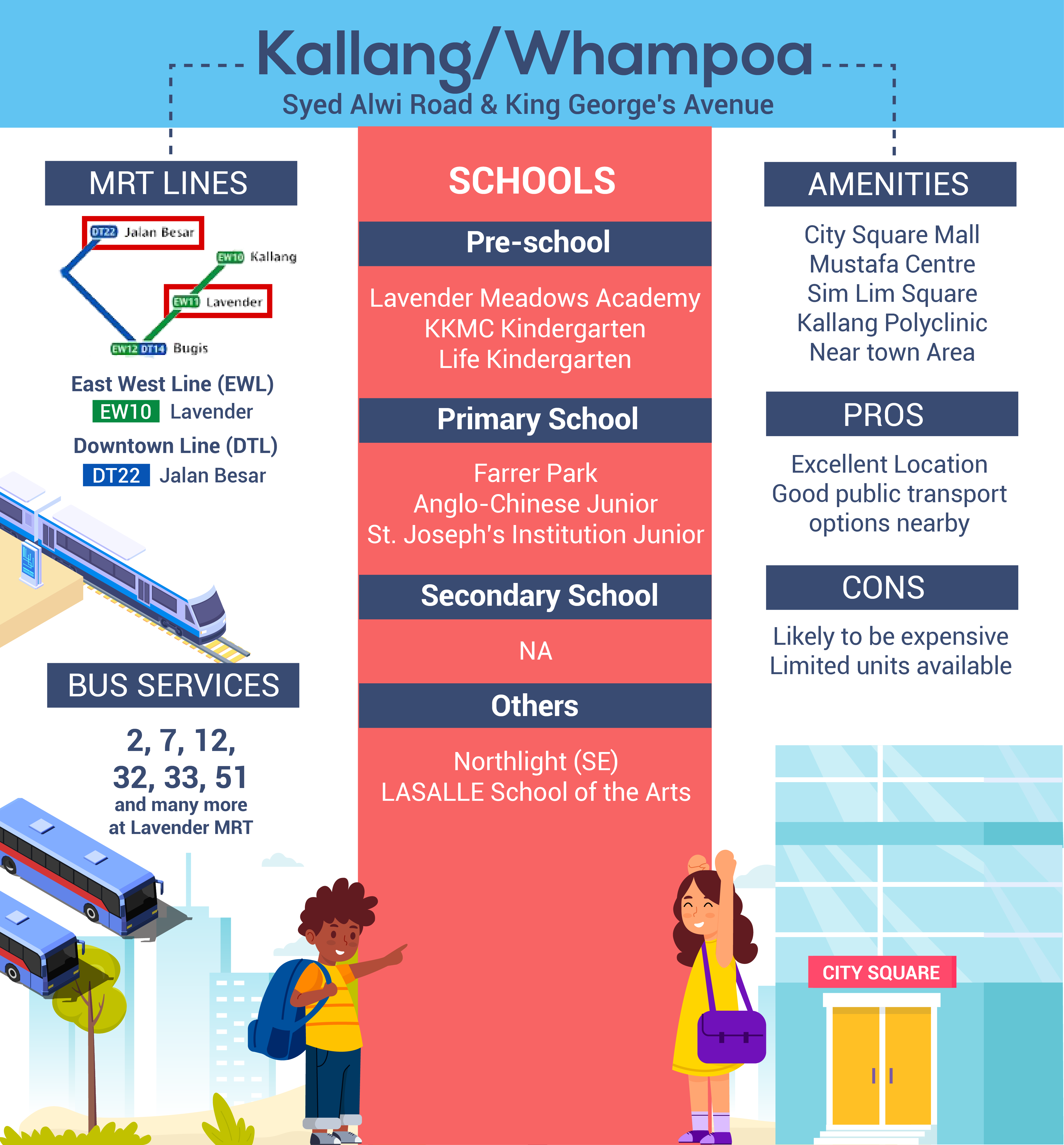

Transport

MRT - 6 mins to Lavender MRT, 10 mins to Jalan Besar MRT, 11 mins to Farrer Park MRT

Bus - 2 mins walk to nearest bus stop, 6 mins walk to biggest bus stop

Drive - 5 mins away from KPE, PIE, CTE

Rating - ⭐⭐⭐⭐⭐

This is the epitome of public transportation - connectivity and accessibility.

Sure, the MRT stations could be a little closer to the BTO, but how often does a sale offer 3 stations with 3 different lines in walking distance?

Not only that, it’s 3 of the most used lines, and is mere stops away from the Central Business District (CBD) if you don’t want to pay the ERP.

Although there may not be a direct bus stop under this block (yet), residents will be just a short walk away from the bus stop at Lavender MRT, which has 14 different bus services.

Education

Rating - ⭐

(Or you know … 5⭐ if you’re not a fan of children).

Kallang/Whampoa lacks the presence of schools, partly due to it being a mature estate.

In fact, the closest primary/secondary school is about a 15min bus ride away. Hence, if you’re planning to enroll your child in that nearby school, be ready for some competition as you’ll be contesting against the other residents.

FYI: I didn’t include Stamford Primary in the infographic because it’s set to merge with Farrer Park Primary in 2023.

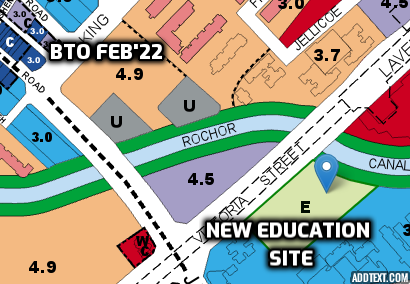

Do take note that there is an upcoming school just south of this BTO.

It’s about a 6 minute walk to the school. But as of now, we do not know what kind of school this will be.

Amenities

Rating - ⭐⭐⭐⭐⭐

The location of this BTO is the true carry, simply because of the amount of things it opens up.

If you’re a foodie, you never have to worry about what to eat again because just look at the number of eating spots in your direct vicinity.

Known staples such as Swee Choon and Scissor-Cut curry rice are just a couple of the myriad of options available in this area. Head south and there’s also Golden Mile Food Centre (not pictured).

For shopaholics, City Square Mall and Mustafa Centre are the nearest. Sim Lim Square will also be in relatively walking proximity for your electronic needs. If you’re looking more for CNY clothes and you’re sick of online shops, the cluster of malls at Orchard/Dhoby/Bugis are less than a 10 min drive away.

For any medical concerns, rest assured that you’ll have Kallang Polyclinic, and the trio of Raffles, Tan Tock Seng and KK Women’s hospital in the area for your body check ups. If you don’t do check ups, then at least you’ll have options for the annual booster shot?? 🤷

There’s also other miscellaneous facilities around like the Jalan Besar Sports Centre/Singapore Sports Hub, Jalan Besar CC, The Projector and Haji Lane.

How much can you earn if you sell this BTO?

If you’re neurotic like me and think everything is a competition and want to know if this BTO will be the most “value”/”worth it”, this may be useful for you.

When it comes to looking at when's the best time to sell your house for maximum profit, the core concept here is the Minimum Occupation Period (MOP).

Simply put, when you buy a house, you need to stay in it for at least 10 years before you can sell it.

This one Gahmen say one

Obligatory disclaimer, everything written below is completely my own opinion.

Here’s what I think the BTO lifespan for the Kallang/Whampoa BTO will look like.

Upside - ⭐⭐⭐

The reason why I gave it 3 stars is because it is important to remember about relativity.

Yes this BTO may eventually be selling for >$900k or even cross the million dollar mark, but relative to what you paid for it, it’s about the same as other resales for mature estates.

This ain’t no pinnacle@duxton 2.0.

The first rise in #1 is common in all BTOs. Since it’s subsidized public housing, it starts below market price, then slowly gravitates towards the market value after 10 years.

In Area X, prices are probably going to be sustained over a period, which is good for those looking to sell because this provides flexibility in when you want to sell. It offers you leverage in cherry picking your time to strike the property market.

A potential point to take note of this BTO is the competitors for housing in the future.

What do I mean by this?

These are all the areas that are allocated for residential purposes in the latest URA Master Plan for this area.

Lavender Gardens has already been in use since 2003, and Citylights is a condo, so we’ll just rule those out.

That leaves ‘Future Housing’ on the left as the sole competition left.

But maybe it’s more soul competition because those future blocks will be built over a Muslim cemetery.

I’m not gonna insinuate anything, but it’s probably gonna be the inspiration forAh Boys to Men: Ghost from Home when Jack Neo directs it in 2040.

So, while it doesn’t have that explosiveness of prices sharply increasing, it can also be seen as prices won’t be as volatile. But who knows what plans the Government has in 20-30 years time for Kallang? It’s just safer to proffer the worst case scenario route for now.

Lastly, the regression in #2 is the slow decline that every HDB unit faces as it winds down to the end of its 99-year lease.

Summary:

14/20 ⭐

Honestly, if you plan to go childless, or if you want to have children but don’t mind fetching them to school that’s out of this area, then this BTO is really an 18/20.

I agree with the consensus that this sale will be the most oversubscribed in this launch, because it does (more or less) offer identical strengths to the Rochor BTO in Nov’21, except this won’t be restricted by the MOP, rent policies and clawback.

If anything, Rochor rejects who have an eye for investment may count their blessings because this would be a more suited option for them.

If you’re looking to secure a BTO urgently, or if you plan to have children, you may stand a better chance at the other BTO sales.

For any questions/feedback/makan recommendations, email me - kyler@mortgagemaster.com.sg

Stay safe y’all.