For the first time since March 2022, after 10 consecutive rate hikes, the US Fed Rate will not increase - at least for now. Yes, they've finally hit the brakes on the interest rate benchmark that rocketed from 0% to 5% in the span of a year. Changes to this influential rate has worldwide repurcussions - we've shown before how the US Fed Rate has a direct impact on Singapore's home loan rates.

Why is the US Fed skipping the rate hike?

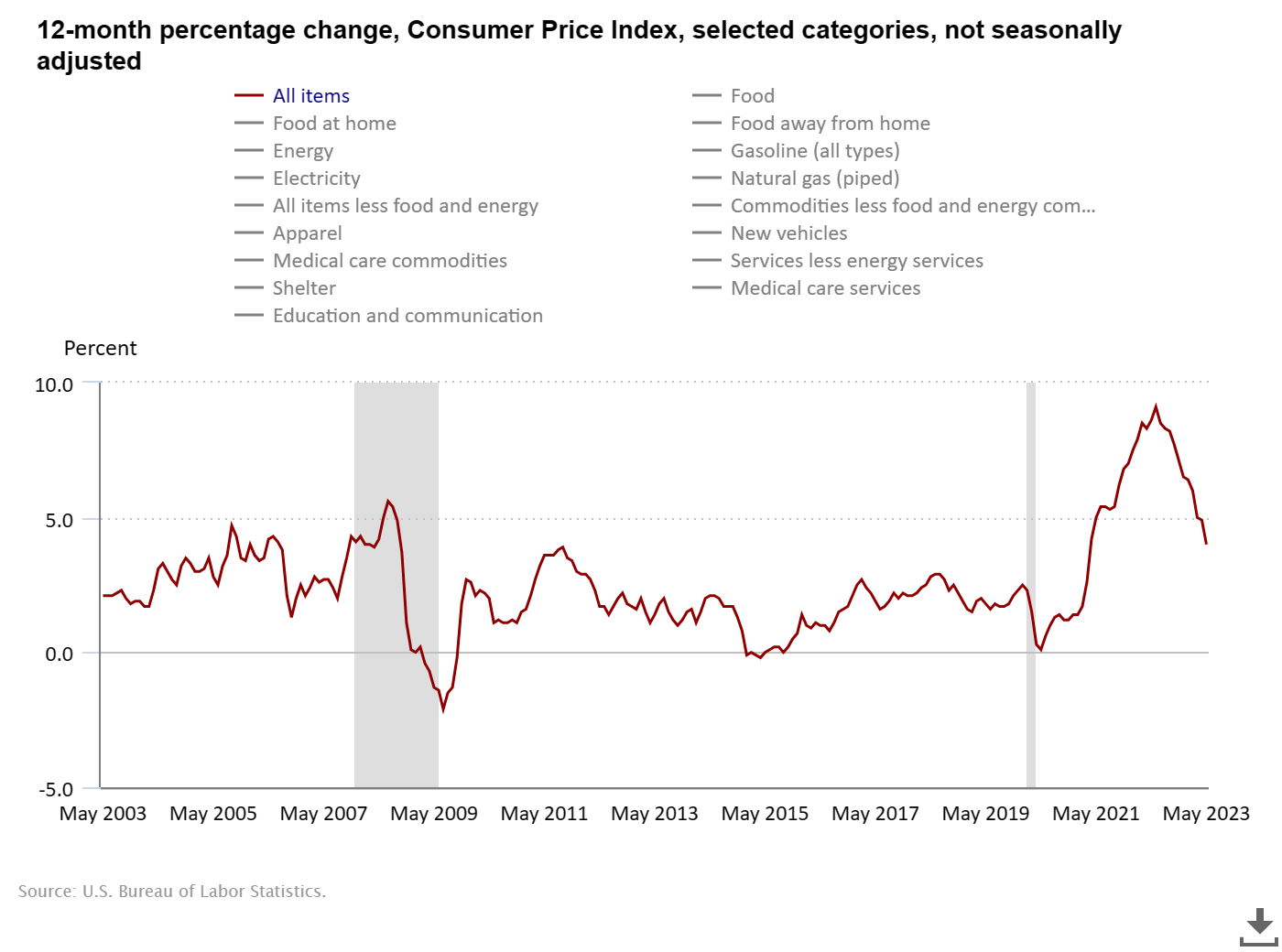

Earlier this week, the monthly Consumer Price Index report revealed that US inflation had risen year-on-year by only 4.0%, the lowest in two years. While still far from the US Fed's goal of 2.0%, it's nonetheless an indicator that the interest rate hikes are having their intended effect.

]

]

This gives the US Fed much needed breathing room to "assess additional information and its implications for monetary policy". Previous Fed decisions did not have this luxury as inflation had been increasing at a record-breaking pace and the belief was that US Fed Funds rate hikes were absolutely necessary.

This 5% rise in just 15 months is unprecedented (you'll need to go as far back as 1980 to see something similar and even then the circumstances were different). Each interest rate hike was also extremely unwelcome, with stock markets taking a hit every time an increase is announced.

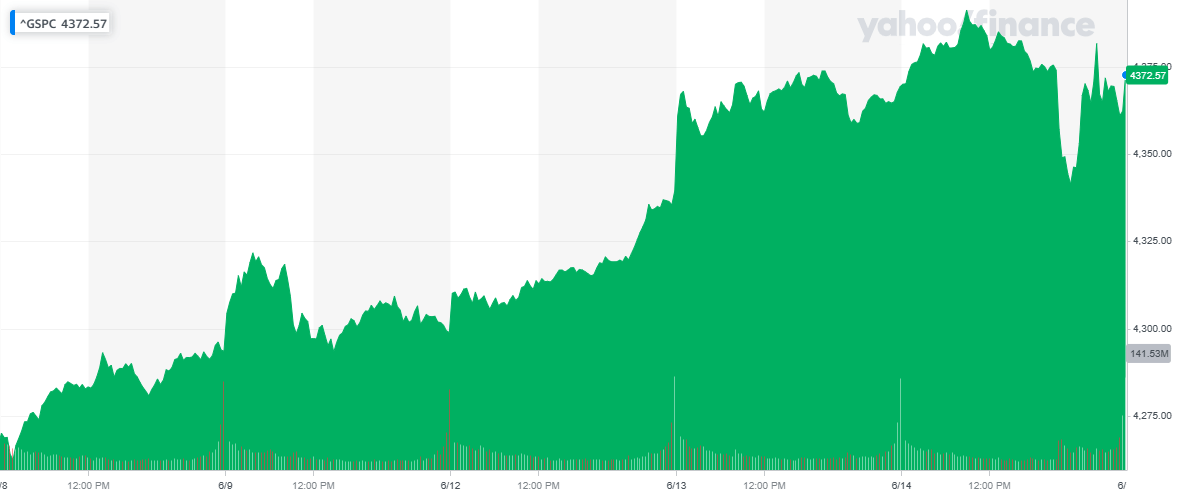

Riding on the hope that the US Fed rate would skip a hike this week, the US stock market has actually been looking extremely optimistic, as demonstrated by the S&P 500.

Does this mean the US Fed is done with the rate hikes?

Unfortunately, the signals being given by the Federal Open Market Committee (FOMC) are mixed, and the stock markets have reacted accordingly. As you can see from the S&P 500 chart above, there was a bit of a dip after the announcement, even though it corrected itself after.

This reflects the nuanced statement of the US Fed chair Jerome Powell, who acknowledged that the "conditions... to get inflation down are coming into place", but who also warned that no one should expect rate cuts as early as this year.

“It will be appropriate to cut rates at such time as inflation is coming down really significantly. And again, we’re talking about a couple of years out. As anyone can see, not a single person on the committee wrote down a rate cut this year, nor do I think it is at all likely to be appropriate.” - Jerome Powell

So the US Fed will be raising rates again?

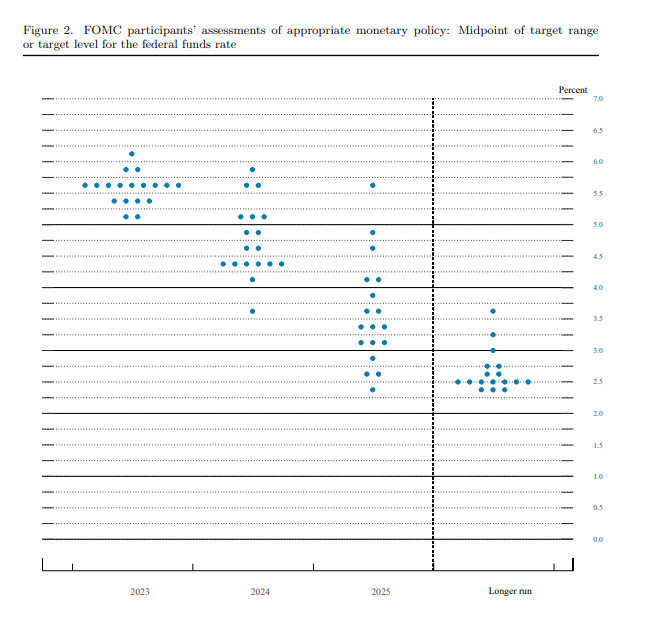

Less nuanced was the "dot plot", where a majority of the members of the US Federal Open Market Committee predicted at least another 0.5% increase, or the equivalent of 2 0.25% rate hikes before the end of this year.

Each "dot" indicates the value of an individual participant’s judgment of the midpoint of the appropriate target range for the federal funds rate or the appropriate target level for the federal funds rate at the end of the specified calendar year or over the longer run.

Simply put, a majority of the FOMC participants believe that the year will end with the US Fed rate between 5.50% and 5.75%, which is 0.5% higher than where it is now.

What does this mean for us in Singapore?

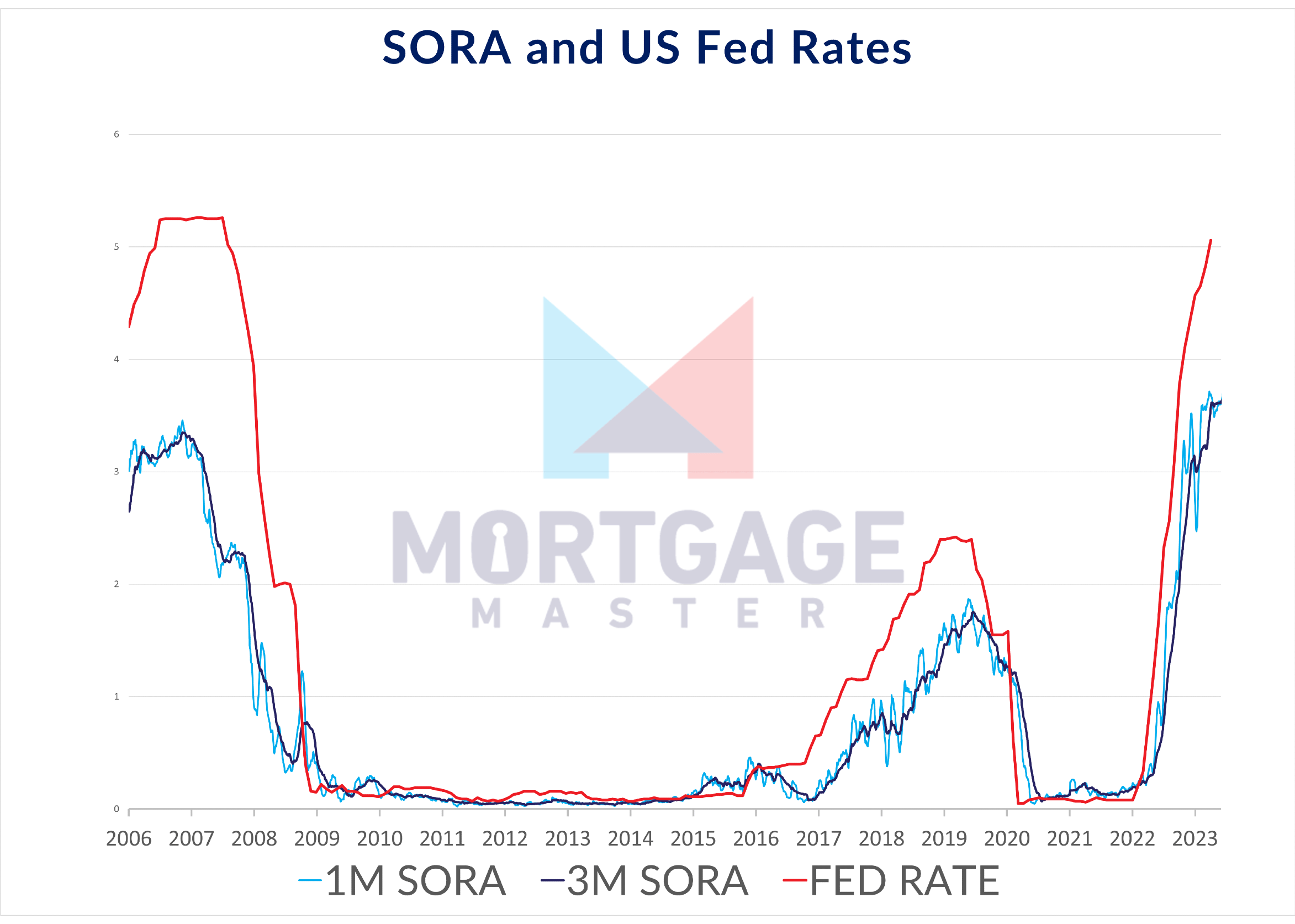

The US Fed rate is so influential that here in Singapore, we see a pretty clear correlation between the US Fed Rate and SORA, the benchmark for all home loans.

SORA is a "backward"-looking interest rate benchmark. This means it reacts to interest rate movements in Singapore. Most new home loans in Singapore are pegged to 3M SORA, which follows a very similar trajectory to the US Fed Funds Rate, as demonstrated by the chart above.

We can therefore expect 3M SORA to remain high, possibly hitting 4.0% by the end of the year as it trails the US Fed Funds Rate. Currently, 3M SORA is at 3.65%.

What you can do if you are currently on a SORA package

Your SORA-pegged home loan package will continue to remain high for the rest of the year. Typically in a rising interest rate environment, a safer bet would be to secure a fixed rate home loan. However, just like the US Fed expects to lower their benchmark by next year, we expect SORA to do the same. Therefore, if you really insist on a fixed rate package, we recommend choosing packages that are only fixed for 1 or 2 years, max.

Why? Because depending on when SORA falls, a fixed rate home loan may appear to benefit you initially, but then you may end up paying more overall for that sense of security.

Fortunately, some banks are even offering a 2-year fixed rate home loan with the flexibility of converting to a floating rate package after the first year!

It is also important to ensure that you make the decision that is right for your current financial situation. A mortgage consultant like Mortgage Master can help you find and lock in home loan packages with the best interest rates, while advising you on the pros and cons of your options.

At Mortgage Master, we know the latest home loan packages in the market and sometimes can even offer exclusive interest rate packages that you cannot get directly from the bank. If you're looking to purchase a new property, or refinance your existing home loan, fill up our enquiry form and our mortgage consultants will follow up with a call.