Everyone knew that the Government was always keeping a close eye on the housing market. Somehow, we all had this inkling that some cooling measure(s) was about to be announced.

Even then, when the Government finally decided to implement the latest round of cooling measures, they took the market by surprise. The announcement was made late in the night of 30th September 2022 and would take effect overnight when Q4 starts.

In this article, we are going to dive into the 4 new property cooling measures that were introduced. In addition, we will share some key insights on what this means for homeowners, for both existing and new homeowners.

Rule Change 1: Private To HDB (Non-Subsidised) Owners Will Need To Wait Longer (15 Months)

The first change on our list is the new waiting period that will be applied for existing private homeowners who want to “downgrade” to HDB.

Old Rule: Under the old rule, you can buy a resale HDB (unsubsidised) at any time. Upon purchase of the resale HDB, you have up to 6 months to dispose of your private condo.

What Changed: With the new rule, you have to FIRST dispose of the private condo and wait for 15 months before you can officially own your next resale HDB.

What Prompted This New Rule?

The recent slate of million dollar HDB flats have certainly caught the attention of the Government. Even properties in Woodlands and Pasir Ris, which are non-city fringe areas, were fetching $1m.

One of the contributing factors to the million dollar HDBs was private condo owners who wanted to upsize their private condo while still cashing out some capital gains. This gave them much more budget to offer an above market price for resale HDBs since a 2-bedroom condo would have easily cost them $1m.

The new rule change would definitely cool demand for resale HDB from private condo owners. The long wait of 15 months will discourage private owners to move back into resale HDBs. This is a stark contract to the old rule where there’s no wait time and you even have a 6 months grace period to sell your old condo.

What Happens To Homeowners Under The New Rule

With the new rule, the biggest question is, where will a family stay in the meantime while you are waiting out for the 15 months? Rental is one option, but 15 months is definitely a long wait.

Will This Rule Last?

According to the press release statement from Ministry of National Development (MND), this rule is going to be temporary. However, the exact duration of this new rule will most likely depend on upcoming HDB resale transactions. If the Government observe the price trend of HDB flats falling, there is a possibility of this rule being removed. That said, given that property prices tend to lag property cooling measures, it may take months before the effect is observed.

Mortgage Master’s Take On The New Rule

With private home sales still relatively strong in the first half of 2022, there is genuine concern that this demand will spill over into the resale HDB market. Interventions from the Government agencies on implementing cooling measures to keep HDB affordable is a timely move.

At the same time, we (and many Singaporeans) are reassured to hear that private property owners facing extenuating circumstances are still able to appeal to HDB on a case by case basis.

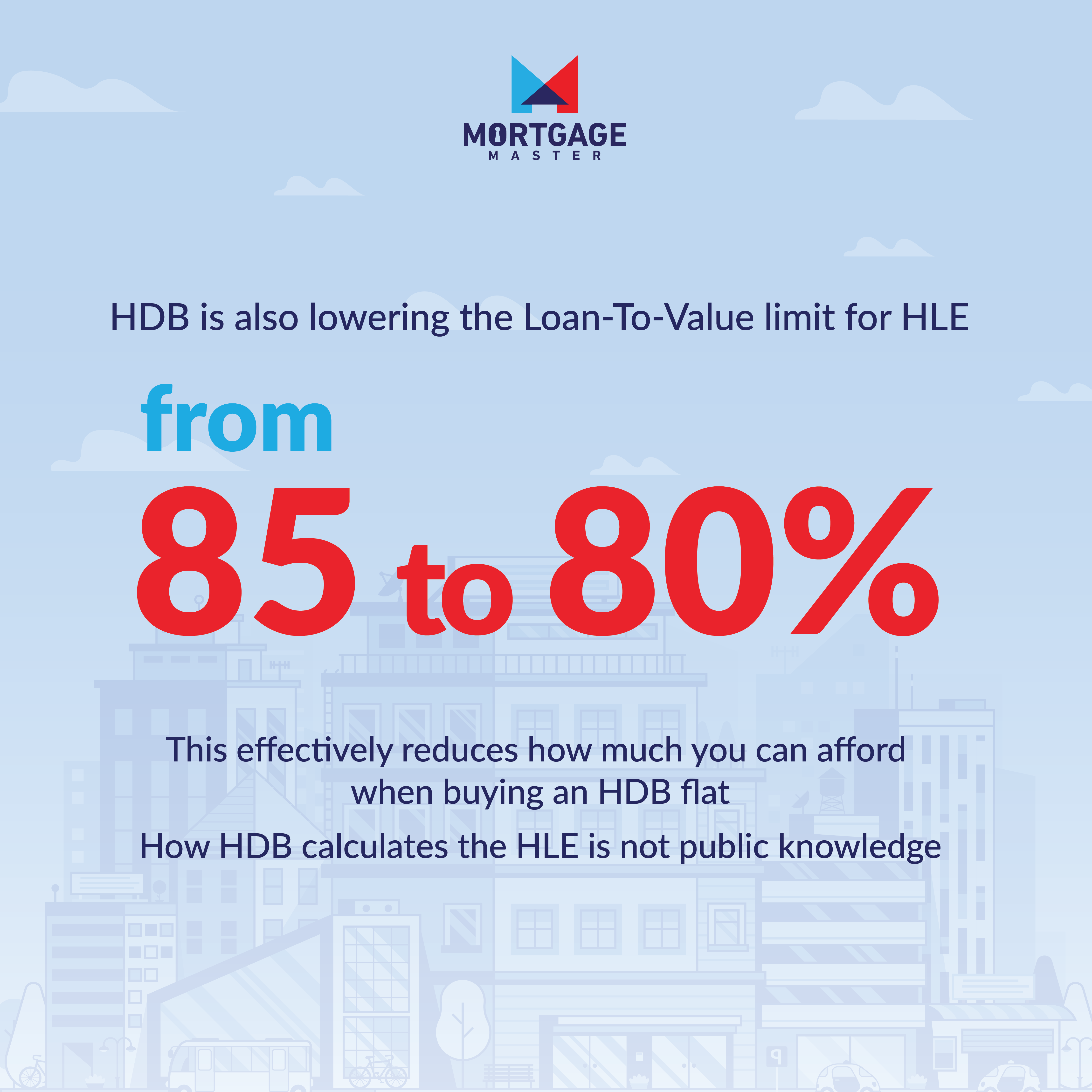

Rule Change 2: Loan-To-Value Limit Drops To 80% for HDB Loan

While the first rule was definitely eye-catching (and perhaps controversial to some), the next rule change that we are elaborating on is something that catches our attention more.

Old Rule: Under the old rule, loan-to-value (LTV) limit for HDB housing loan is 85%. This figure was only recently adjusted to down from 90% in December 2021.

What Changed: With the new rule, LTV limit for HDB housing loan will drop another 500 basis points to 80%. What Stayed: For those who are considering taking a bank loan, the LTV limit is still capped at 75%.

What Prompted This New Rule?

The trending resale HDB prices is due to strong demand from new homeowners. Because of the ease of getting credit for homes, homeowners are committing to higher buying prices. Well, it doesn’t apply to everyone but some homebuyers are definitely trying to outbid their fellow buyers.

As such, the way to curb this behaviour is to reduce the loan limit that one can get through an HDB housing loan.

What Happens To Homeowners Under The New Rule

The most immediate impact of this is that families will have to fork out more cash/CPF upfront. 20% of the property valuation needs to be paid for by either cash or CPF.

We think that the underlying change that MND and Monetary Authority of Singapore (MAS) expects is for homebuyers to exercise more prudence when paying for a resale HDB. That’s because more money has to come out of your own pocket first before you get the credit from HDB housing loan. This will likely cool down the prices of resale HDB in the coming months.

Who Can Help Me Calculate My New Affordability?

With the new rule change, it can be confusing for some of us to recalculate our affordability. Thus, we recommend to engage a mortgage broker like Mortgage Master where we can help you navigate through the new cooling measures.

For instance, Mortgage Master can help you plan out your finances and determine what's the budget for your next home. This will ensure that you stay on the safe side of your own finances and avoid unwanted consequences from overleveraging.

Rule Change 3: Higher Interest Rate Used To Calculate TDSR

Total Debt Servicing Ratio, or TDSR, is the portion of a borrower's gross monthly income that can go towards repaying monthly debt obligations. The TDSR framework helps to ensure that borrowers don't take on more debt than they can handle. At the same time, it also ensures that financial institutions (i.e. banks) lend responsibly.

In the existing TDSR framework, there is a medium-term interest rate that is used to calculate the maximum loan quantum that homeowners can borrow. This interest rate value is used as a stress test value to determine the maximum loan quantum for a homebuyer.

Old Rule: A floor rate was applied. However, this floor rate was much lower than the prevailing interest rates. Thus, 3.5% was always used for the calculation of TDSR.

| Type of Loan | Medium-Term Interest Rate Floor |

|---|---|

| Residential property | Higher of 3.5% or interest rate on the loan package |

| Non-residential property | Higher of 4.5% or interest rate on the loan package |

What Changed: With the new rule, the medium-term interest rate floor is raised by 50 basis points. This takes effect from 30th September 2022.

| Type of Loan | Medium-Term Interest Rate Floor |

|---|---|

| Residential property | Higher of 4.0% or interest rate on the loan package |

| Non-residential property | Higher of 5.0% or interest rate on the loan package |

What Happens To Homeowners Under The New Rule

The impact of a higher medium-term interest rate is straightforward. This will likely mean the maximum loan quantum for a homebuyer will be lower. Homebuyers will either have to fork out more cash/CPF or settle for a property with a lower valuation.

How Does This Affect Your Affordability?

Let’s consider the scenario that you are planning to buy a $2m condo. Under the old rule where a medium-term interest rate of 3.5% was used, your monthly mortgage repayment amounts to $11,599.19.

With the new rule, your monthly mortgage repayment would theoretically go up to $12,119.61. Under the TDSR framework, you need to ensure that this monthly mortgage repayment constitutes up to a maximum 55% of your combined household income.

Does This Mean My Monthly Mortgage Repayment Is Shooting Through The Roof?

Before you start panicking and think that you need to pay higher interest rate, calm down first. Take note that these two calculations are NOT what you will be paying each month. The actual amount that you will be paying is based on your bank loan package.

These two are just stress test scenarios to simulate what happens if interest rate goes up to 3.5% and 4%. They are just “WHAT IF” scenarios that may happen. And if it happens, can you still afford to pay the monthly mortgage repayment to your bank? That’s the big question that MAS is trying to answer with the TDSR framework.

Rule Change 4: Introduction Of Interest Rate Floor To Calculate MSR

In conjunction with rule change no. 3, a floor interest rate will also be introduced for the Mortgage Servicing Ratio (MSR). MSR is the sibling of TDSR that applies to HDB housing loan.

Old Rule: There was no floor interest rate used in calculating the MSR. The floor interest rate was pegged to the prevailing CPF Ordinary Account (OA) interest rate + 0.1%, i.e. 2.6% (2.5% + 0.1%).

What Changed: With the new rule, the interest rate will be the higher of 3%, or the prevailing CPF Ordinary Account (OA) interest rate + 0.1% (2.6%).

What Happens To Homeowners Under The New Rule

If you are borrowing $500,000 from HDB, you will be paying $2,673 every month for your mortgage repayment.

However, when calculating your MSR, a floor interest rate of 3% will be used. Based on this floor interest rate, your monthly mortgage repayment will be $2,772.99. You need to ensure that this monthly mortgage repayment of $2,772.99 is within 30% of your combined household income.

Otherwise, your total loan quantum will be reduced down from $500,000 to an amount that you can afford based on the 30% MSR.

Calculate Your Own Mortgage Repayment Using Our Mortgage Calculator

Homebuyers who are keen can also try to recalculate your own TDSR and MSR using our mortgage calculator. It’s free!

Why Is MAS Introducing/Updating This Floor For TDSR And MSR?

This is the first time that MAS is recognising that "thereafter rates" are also important factors in determining loan quantum. Under the previous rule, both TDSR and MSR were based on a floor rate which were deemed to be quite high under the previous low interest rate environment.

Essentially, MAS is acknowledging that there is a possibility that “thereafter rates” could go above the old floor rates for 3.5% (bank loan) and 2.6% (HDB housing loan). This is an early signal that MAS is sending to the market that, even though current bank loan packages do not have such a high interest rate yet, homeowners should still exercise more prudence and caution when taking up a mortgage.

What Can Homeowners Do Right Now?

For many of us, the pertinent question will be about our next move. What should we be doing or expecting in the months to come?

For existing homeowners, the first thing you can do is to check whether your bank loan is still under a lock-in period. If it isn’t, you can consider doing a refinance on your bank loan to ensure that you are getting the best deal on your mortgage.

At Mortgage Master, we know the latest home loan packages in the market and sometimes can even offer exclusive interest rate packages that you cannot get directly from the bank. If you're looking to purchase a new property, or refinance your existing home loan, fill up our enquiry form and our mortgage consultants will follow up with a call.

For upcoming homeowners, be sure to reach out to your bank first to get an in-principle approval (IPA). This will help determine your affordability for your next home. Alternatively, you can engage a mortgage consultant like Mortgage Master to advise you on your affordability based on your current combined household income.