With Christmas around the corner, everyone was looking forward to the festive break and the surprise Christmas gifts. But nobody would have expected (nor wanted) the “surprise” property cooling measures that were announced at 11.40pm on 15th December 2021. The property cooling measures sure took everyone by surprise and the market is still reeling from the announcement.

We will be digging into the details of new property cooling measures announced to help you comprehend what changed overnight. We will also be sharing about what excites us and what worries us about the new property cooling measures. So, if you are planning to buy a property in the next couple of years, here’s what you need to know.

If you prefer to listen to our discussion, check out our podcast episode:

Without further ado, here we go!

1. Raising ABSD: Reducing Demand By Discouraging Ownership of Multiple Properties

One of the driving factors for the rising property prices in Singapore is because of property owners owning multiple properties. The desire to own multiple properties led to increased demand in the market that created an imbalance in the market demand and supply.

Therefore, it is no surprise that this was one of the areas targeted by the government in its latest property cooling measures. To discourage owning multiple properties, all property owners who own more than one property will need to pay an increased rate of Additional Buyers Stamp Duty (ABSD). The increase will go up between 5 basis points (bp) to 10 bp, depending on your profile.

Source: go.gov.sg/coolingmeasures

| Additional Buyer Stamp Duty (ABSD) | ||||

|---|---|---|---|---|

| From 8 Dec 2011 to 11 Jan 2013 | From 12 Jan 2013 to 5 Jul 2018 | From 6 Jul 2018 to 15 Dec 2021 | From 15 Dec 2021 onwards | |

| Singapore Citizens (SC) | ||||

| SC buying 1st residential property | Not applicable | Not applicable | Not applicable | Not applicable |

| SC buying 2nd residential property | Not applicable | 7% | 12% | 17% |

| SC buying 3rd and subsequent residential property | 3% | 10% | 15% | 25% |

| Singapore Permanent Resident (SPR) | ||||

| SPR buying 1st residential property | Not applicable | 5% | 5% | 5% |

| SPR buying 2nd residential property | 3% | 10% | 15% | 25% |

| SPR buying 3rd and subsequent residential property | 3% | 10% | 15% | 30% |

| Foreigners | ||||

| Foreigners buying any residential property | 10% | 15% | 20% | 30% |

| Entities | ||||

| Entities buying any residential property | 10% | 15% | 25% plus additional 5% for housing developers (non-remittable) |

35% plus additional 5% for housing developers (non-remittable) |

How It Affects You

Well, if you are a genuine buyer for your first property, the cooling measure shouldn’t affect you (much). Those are the words from our Minister for National Development Desmond Lee. Indeed, if you are a Singaporean, or Permanent Resident (PR) buying your first property, the 0-5% ABSD shouldn’t drastically affect your affordability.

However, if you are thinking about owning multiple properties, then the latest ABSD hike is something to reconsider. Paying 17-25% ABSD on your second property seems pretty steep in our opinion. In order for you to break even from your investment, you will need to make a 17-25% capital gain. That seems like a tall order for properties in general.

That said, hope is not all gone for those who likes investing in properties. After all, a report from DBS showed that returns from owning a second property in the last decade would have yielded 109% return.

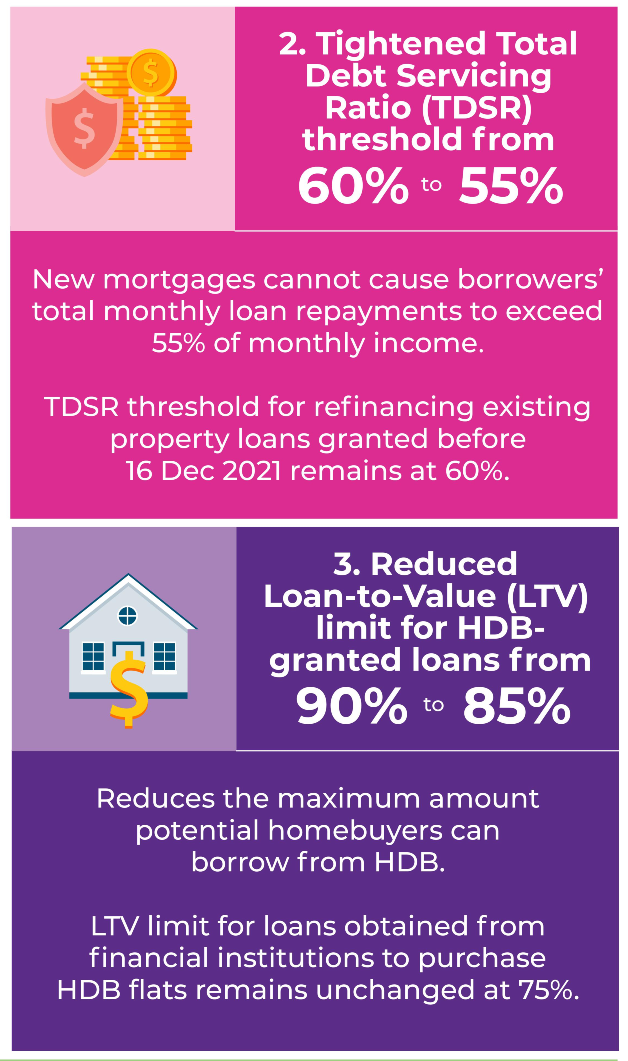

2. Lower LTV, TDSR: Reduce Demand By Reducing Over-Leveraging

Apart from charging higher ABSD for property buyers, another part of the property cooling measures giving homebuyers lesser leverage.

Under the new property cooling measures, the Total Debt Servicing Ratio (TDSR) will be reduced to 55% (from 60%). In addition, the Loan-to-Value (LTV) for HDB housing loan will be tightened from 90% down to 85%.

Source: go.gov.sg/coolingmeasures

How It Affects You

The lower leverage (TDSR, LTV) means that homebuyers will be able to get lower loan amount from the bank or HDB. The consequence of this is that homebuyers will need to fork out more down payment regardless of whether you are taking an HDB housing loan or a bank loan. Both will require you to put in an extra 5% in cash/CPF.

The most likely reason why the government reduced both LTV and TDSR is simple. If they simply chose one over the other (i.e. reduce LTV but not TDSR, or vice versa), then it will cause homebuyers to rush to the other side.

What You Should Look Out For

The most direct impact of lower TDSR and LTV is that homebuyers’ affordability will be affected.

For instance, if you are planning for a $500k HDB, you will need to pay additional $25k in cash/CPF as down payment. It is not a small amount which one can fork out overnight. This creates a higher barrier to entry for first-time HDB homebuyers.

For condo buyers, a 5% reduction in TDSR indirectly impacts the amount of down payment that you need to fork out.

Under the 60% TDSR, a couple will need to make around $8k a month to afford a $1.3m condo. This translates to $4.9k being used for monthly repayment of the condo mortgage assuming that you have no other outstanding debt. If the TDSR is reduced to 55%, you will need a combined household income of almost $9k. Otherwise, you will need to pay more down payment (~10% of the property value) and take lesser loan.

This can cause condo buyers to be priced out of the condo market, especially for those borderline cases that make it just pass the mark to afford a condo based on the TDSR criterion. As such, the group that is most affected by this new LTV/TDSR rule change is the sandwiched buyers. This is the group of buyer who can barely afford condo but was also earning too much to own an HDB or Executive Condo (EC).

What You Can Do About It

The imperative of being more prudent with your housing loan has never been so strong. The latest property cooling measures is a reminder of how important affordability is to owning a property in Singapore. One proven method of improving your affordability is to seek for the best housing loan deals through a mortgage broker like Mortgage Master. Plus, with the gap between HDB loan and bank loan getting closer than ever (LTV 85% for HDB vs 75% for bank), one needs to really make the right choice between lower interest (bank) and lower down payment (HDB).

3. Increasing Supply: Market Is About To See A Significant Increase In Supply

In order to help the property market return to equilibrium, managing the demand alone isn’t going to be enough. An experienced economist knows that you need to balance both the supply and demand in order to manage the property prices in Singapore. Luckily, the government is taking steps to manage the root cause of the property price inflation problem: The lack of supply.

Because of Covid, BTOs and new condo launches are getting delayed. At the same time, developers’ land bank are also diminishing. These factors have led to a lack of supply in the market to meet with the demand. As such, buyers have been turning to the resale market. Between 2015 and 2017, there were less than 20,000 properties sold per year on average. However, in the previous two years, around 24,000 were sold on average. This led to the rising home prices in Singapore.

To cope with the supply issue, HDB will be launching more BTO flats in the next two years. 23k HDB flats will be launched each year, which represents a 35% increase from the 17.1k HDBs launched in 2021. At the same time, the confirmed list of Government Land Sales (GLS) in H1 2022 will yield around 2.8k residential units, which is a 40% increase from H2 2021.There are also another 3.7k residential units potentially waiting on the reserve list that can be sold if needed.

What Excites Us

Increasing supply is definitely the way to go to curb property prices. In addition, greater supply also signals to the market that there will be more options coming soon. Homebuyers don’t have to rush into the market for fear of missing out on good housing options. This will help to meeting the growing demands and eventually create an equilibrium on property prices. This should help to pause the valuation growth of resale properties in the medium term.

At Mortgage Master, we know the latest home loan packages in the market and sometimes can even offer exclusive interest rate packages that you cannot get directly from the bank. If you're looking to purchase a new property, or refinance your existing home loan, fill up our enquiry form and our mortgage consultants will follow up with a call.