If you are on the sidelines waiting to enter the property market, chances are you might be struck with fear of missing out (FOMO). This is made worse when you see reports of new launch prices (or just property prices in general!) climbing every month for the past two years.

But letting FOMO get the better of you can lead to misjudgements and making the wrong moves in the property market. In this guide, we want to share useful tips to help you learn what you need to look out for in a new launch condo so that you aren't driven purely by FOMO.

Here are 6 tips to keep in mind when considering whether to grab a unit at the next new launch condo project.

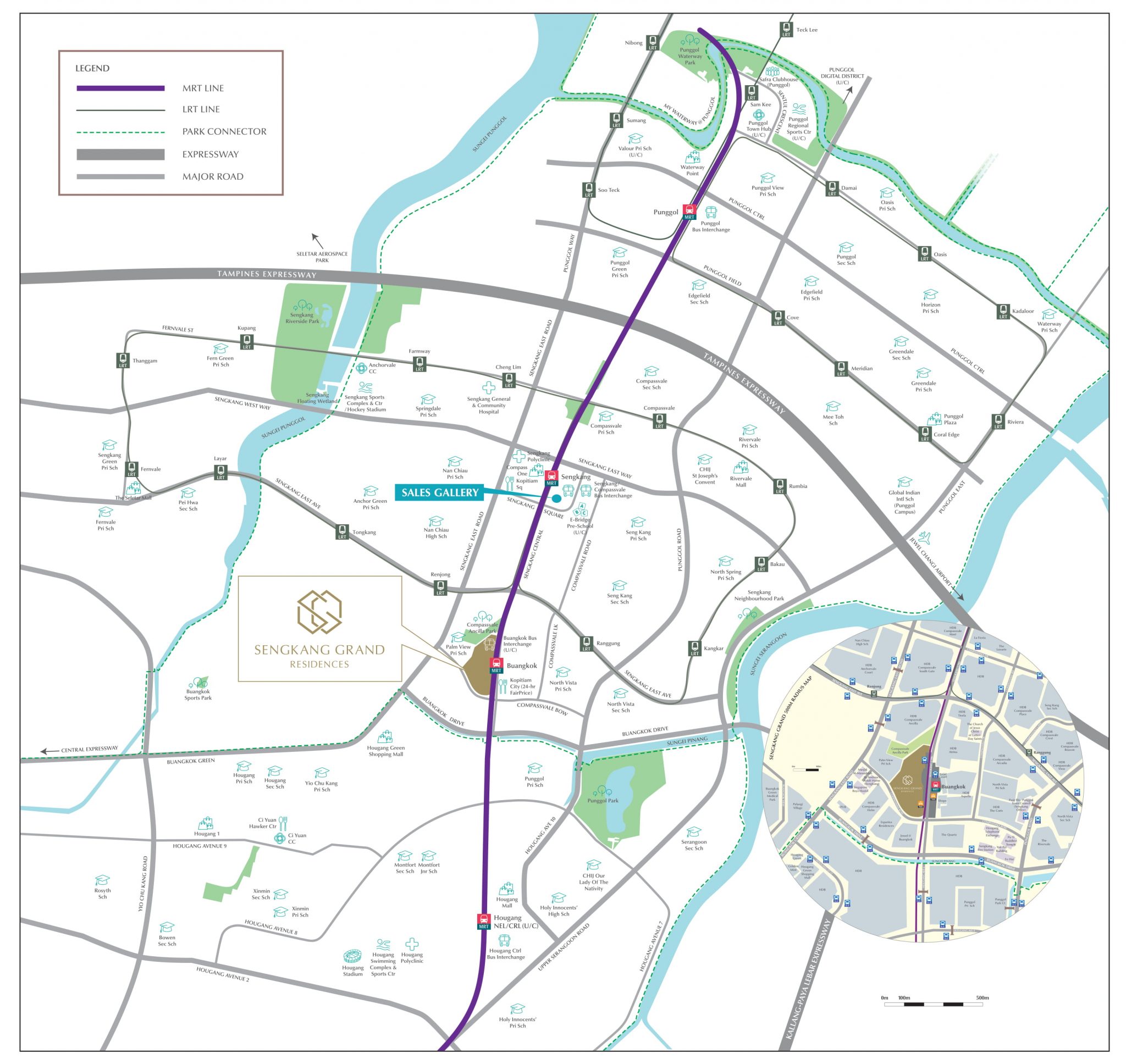

1. Location Map: Don’t Be Fooled By The Scale

For every new launch condo, you are bound to come across a location map that looks like the above. It will be there in the brochure and also on a giant wall in the new launch showroom if you are visiting in person.

The reason why the location map is a mainstay in almost all the marketing collaterals and in the showroom is because the developer understands that location is important for a property. From the developer’s perspective, they are using the location map to highlight all the amenities around the new launch condo to get your buy-in. One thing to note when viewing the location map is the scale. There isn’t really a rule to state that the location map can only cover up to a certain radius (e.g. 2km) from the condo. The developer can extend the map as far as they like, as long as there isn’t a misrepresentation in terms of the scale, i.e. the small bar that appears at the bottom right.

To illustrate our point, we will be comparing the location map between Sengkang Grand Residences and Normanton Park. While the two location maps might look similar in size on the brochure, you will notice that the scale at the bottom right of the map is quite different.

Source: Sengkang Grand Residences

Source: Sengkang Grand Residences

The scale of the map allows you to appreciate the surrounding of Buangkok with roughly 3km radius. It is a justified zoomed out view of the Buangkok area to allow property agents to show potential buyers what are the kind of amenities you can enjoy if you were to buy a unit at Sengkang Grand Residences.

Source: Normanton Park

Source: Normanton Park

The scale of this map however, seems to stretch it a bit too far. Normanton Park is located around Kent Ridge but the location map stretches all the way to the Central Business District (CBD). Based on Google Maps, Normanton Park is about 7km away from the CBD. In fact, the area covered by this location map is almost 10% of Singapore’s total area.

2. Facilities: Quantity Over Quality

Besides being influenced by the location map, there are other potential missteps that beginner homebuyers or investors might make. Since most new launch condos are like build-to-order HDB flats (BTOs), you can’t really scrutinize the quality of facilities that will be available at the condo. As such, you will often hear the property agent tout about the quantity of facilities and amenities rather than the quality.

Source: Parc Central Residences EC

Source: Parc Central Residences EC

Using Parc Central Residences Executive Condo (EC) as an example, you can find 88 different facilities based purely from the index of the facilities on the site plan. However, there are many on the list that you would not even consider as a usable facility.

For instance, the guard house, roundabout, drop-off plaza, lift, staircase, and waiting lounge are considered facilities. While you will probably use them occasionally, would you really consider them "facilities"?

Auxiliary services are also lumped under this list of facilities. If you simply take the index of facilities at face value, you would have assumed that side gate and bin centre as facilities.

Along Tampines Avenue 10, you will find many numbered facilities under “The Lawn”. This seems to be a hyperinflation of what you will deem as facilities. Every tree and lawn is classified as a facility on its own. But think about it. Do you really use them as a standalone facility? Or would you just appreciate the whole landscape as one “facility”?

To be fair, the developer never once said that these are facilities in their marketing collaterals. The regulation is pretty strict when it comes to making representation about what is there in the new launch condo. Even the image itself reads “Siteplan”, not “Facilities”.

However, when it comes down to the property agent, it becomes much harder to control what is said and sold to a potential buyer. As a home owner or investor, the onus is on you to suss out these kind of information by making shrewd observations about the information presented to you.

3. Price: PSF vs Quantum

As a budding property buyer/investor, price per square foot (PSF) and the selling price (quantum) of the property may sound the same. After all, both are metrics indicating how much the property is selling for. However, to a savvy condo veteran, these 2 price metrics can be very different and affect your property buying decision. That’s because these 2 price metrics typically move in opposite direction.

Properties with higher quantum tend to have a lower PSF compared to a low quantum property. Another way to look at it is that properties with larger area typically sell for a lower PSF and vice versa. Although the PSF is lower, the quantum will be larger for bigger properties due to the larger area.

If you are buying a property for your own stay, then it is important to consider the quantum. That’s because you need to ensure you can afford the quantum as you will likely need to borrow from the bank to finance it. Plus, it’s a large financial commitment over the next 30 years. You don’t want to overburden your own finances buying something that is out of your reach.

For savvy condo condo-isseurs, they usually start with an in-principle loan approval first before they start property shopping. This can be done through a mortgage broker like Mortgage Master.

As a property investor, you can consider either a low PSF or low quantum property depending on how you want to be invested. For example, if you are looking to flip the property, it may make more sense for you to consider properties with lower quantum so that you have a bigger room to flip the property. If you are looking to invest in the property for rental income, then a lower PSF might be the more sensible choice as it may offers a higher return on your investment.

4. Price: Comparing Against Surrounding Resale Prices

Besides looking at the selling PSF and quantum for the new launch condo, savvy property buyers also consider what’s in the vicinity. They will compare the selling price for the new launch condo with resale condos in the surrounding area to make sure that they are indeed getting the best bang for their buck.

New launch condos usually sell at a premium compared to nearby condos in the resale market. The question is whether it is worth getting the higher priced new launch condo which is not only more expensive, but you also have a wait longer.

If the surrounding resale condos have much shorter lease and you are looking for a property for your own stay, then it might make sense. But if the nearby resale condo is also quite new, then why not consider one in the resale market? Plus, you don’t have to wait for the condo to be built.

For property investors, you need to think about either the price appreciation or rental yield for the property. New launch condos have a higher likelihood of price appreciation gains because of the one-time appreciation after temporary occupation permit (TOP). This is unlikely to occur for a resale condo. However, what a resale condo is able to offer is better rental yield since the selling price is lower. In addition, you don’t have to wait for the condo to be built. You can rent it out straight from day one after you buy over the resale condo.

5. Home Loan: Finding The Most Value For Money, Not The Most Convenient

Savvy condo-isseurs are not only good at calling bluffs and doing price comparisons, they also do a great job at finding value-for-money bargains. One area that they like to exploit is on home loans. Since almost every property buyer needs to use a home loan, it is something that we can all learn a thing or two from the savvy condo-isseurs.

For these savvy condo-isseurs, they understand the home loan market quite well. They know that it is a competitive market where every bank out there trying their best to grab market share of the mortgage market. The way for these banks to do that is to provide the best home loan offer with the lowest interest rate.

As a property buyer, you can leverage on that to find home loan that gives you the most value-for-money, even if it means signing for a bank that you aren’t using yet. While some banks are using high interest account to lure you back to using the same bank, make sure you do your own calculation to check if it is indeed the most savvy deal for you. Sometimes, you might save even more by switching to another bank and forgoing the high interest in your saving account, especially if you don’t keep much savings anyway.

6. Home Loan: Refinancing At The Right Time

The other thing that savvy condo-isseurs exploit is the art of refinancing. For the uninitiated, every home loan has a lock-in period (typically 2 years) where you need to commit to the bank.

However, once the lock-in period is up, there’s no stopping you from switching to another bank where the interest rate is lower. You can also stick with the same bank but take up a home loan package where the interest rate is much more attractive than your current package.

The reason for doing this is that you can take advantage of the more attractive home loan package to reduce the cost of financing your property. The lesser you spend on financing your property, the more you get to keep as profits as your property appreciates.

At Mortgage Master, we know the latest home loan packages in the market and sometimes can even offer exclusive interest rate packages that you cannot get directly from the bank. If you're looking to purchase a new property, or refinance your existing home loan, fill up our enquiry form and our mortgage consultants will follow up with a call.